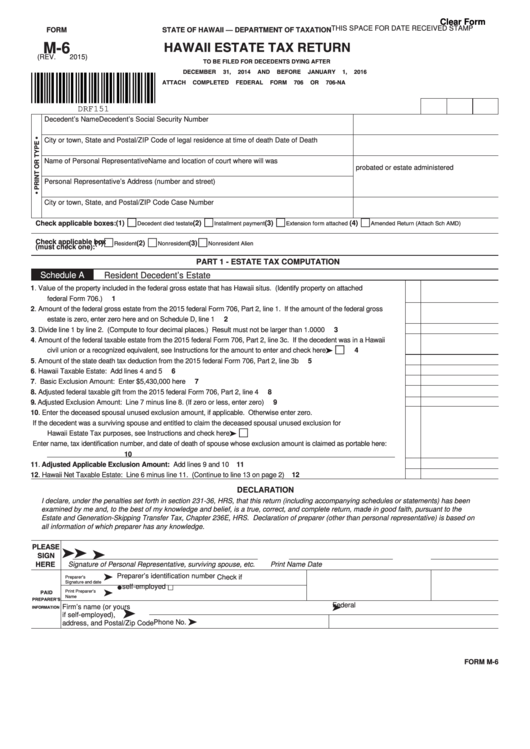

Clear Form

THIS SPACE FOR DATE RECEIVED STAMP

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

HAWAII ESTATE TAX RETURN

M-6

(REV. 2015)

TO BE FILED FOR DECEDENTS DYING AFTER

DECEMBER 31, 2014 AND BEFORE JANUARY 1, 2016

ATTACH COMPLETED FEDERAL FORM 706 OR 706-NA

DRF151

Decedent’s Name

Decedent’s Social Security Number

City or town, State and Postal/ZIP Code of legal residence at time of death

Date of Death

Name of Personal Representative

Name and location of court where will was

probated or estate administered

Personal Representative’s Address (number and street)

City or town, State, and Postal/ZIP Code

Case Number

Decedent died testate (2)

Installment payment (3)

Extension form attached (4)

Amended Return (Attach Sch AMD)

Check applicable boxes:

(1)

Check applicable box

Resident

Nonresident

Nonresident Alien

(1)

(2)

(3)

(must check one):

PART 1 - ESTATE TAX COMPUTATION

Schedule A

Resident Decedent’s Estate

1.

Value of the property included in the federal gross estate that has Hawaii situs. (Identify property on attached

federal Form 706.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2.

Amount of the federal gross estate from the 2015 federal Form 706, Part 2, line 1. If the amount of the federal gross

estate is zero, enter zero here and on Schedule D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3.

Divide line 1 by line 2. (Compute to four decimal places.) Result must not be larger than 1.0000 . . . . . . . . . . . . . . . . . . .

3

4.

Amount of the federal taxable estate from the 2015 federal Form 706, Part 2, line 3c. If the decedent was in a Hawaii

civil union or a recognized equivalent, see Instructions for the amount to enter and check here . . . . . . . . . . . . . . .

4

5.

Amount of the state death tax deduction from the 2015 federal Form 706, Part 2, line 3b . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6.

Hawaii Taxable Estate: Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7.

Basic Exclusion Amount: Enter $5,430,000 here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8.

Adjusted federal taxable gift from the 2015 federal Form 706, Part 2, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9.

Adjusted Exclusion Amount: Line 7 minus line 8. (If zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Enter the deceased spousal unused exclusion amount, if applicable. Otherwise enter zero. . . . . . . . . . . . . . . . . . . . . . . . .

If the decedent was a surviving spouse and entitled to claim the deceased spousal unused exclusion for

Hawaii Estate Tax purposes, see Instructions and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. .

Enter name, tax identification number, and date of death of spouse whose exclusion amount is claimed as portable here:

10

11. Adjusted Applicable Exclusion Amount: Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12. Hawaii Net Taxable Estate: Line 6 minus line 11. (Continue to line 13 on page 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this return (including accompanying schedules or statements) has been

examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith, pursuant to the

Estate and Generation-Skipping Transfer Tax, Chapter 236E, HRS. Declaration of preparer (other than personal representative) is based on

all information of which preparer has any knowledge.

PLEASE

SIGN

HERE

Signature of Personal Representative, surviving spouse, etc.

Print Name

Date

Preparer’s

Preparer’s identification number

Check if

Signature and date

self-employed

Print Preparer’s

PAID

Name

PREPARER’S

Federal

INFORMATION

Firm’s name (or yours

E.I. No.

if self-employed),

Phone No.

address, and Postal/Zip Code

FORM M-6

1

1 2

2 3

3