Form Dq-1-R - Local Earned Income Tax

ADVERTISEMENT

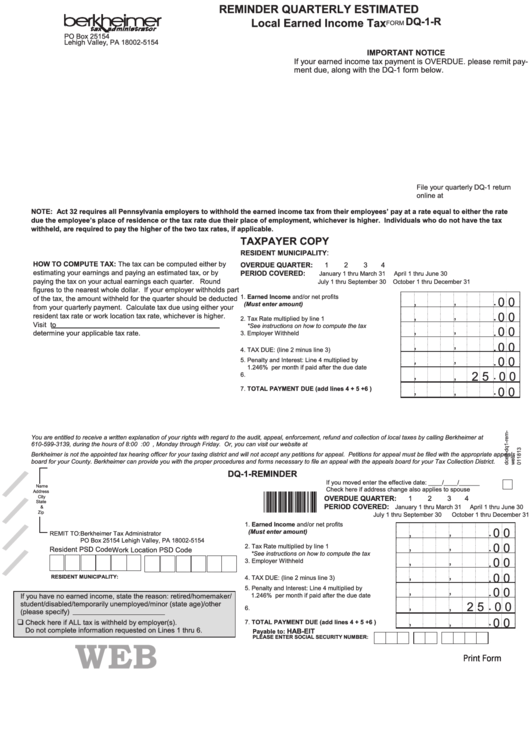

REMINDER QUARTERLY ESTIMATED

DQ-1-R

Local Earned Income Tax

FORM

PO Box 25154

Lehigh Valley, PA 18002-5154

IMPORTANT NOTICE

If your earned income tax payment is OVERDUE. please remit pay-

ment due, along with the DQ-1 form below.

File your quarterly DQ-1 return

online at

NOTE: Act 32 requires all Pennsylvania employers to withhold the earned income tax from their employees’ pay at a rate equal to either the rate

due the employee’s place of residence or the tax rate due their place of employment, whichever is higher. Individuals who do not have the tax

withheld, are required to pay the higher of the two tax rates, if applicable.

TAXPAYER COPY

:

RESIDENT MUNICIPALITY

HOW TO COMPUTE TAX: The tax can be computed either by

OVERDUE QUARTER:

1

2

3

4

estimating your earnings and paying an estimated tax, or by

PERIOD COVERED:

January 1 thru March 31

April 1 thru June 30

paying the tax on your actual earnings each quarter.

Round

July 1 thru September 30

October 1 thru December 31

figures to the nearest whole dollar. If your employer withholds part

1. Earned Income and/or net profits

.

of the tax, the amount withheld for the quarter should be deducted

0 0

,

,

(Must enter amount) ....................................................

from your quarterly payment. Calculate tax due using either your

.

,

0 0

,

resident tax rate or work location tax rate, whichever is higher.

2. Tax Rate multiplied by line 1 ..........................................

Visit to

*See instructions on how to compute the tax

,

,

0 0

.

determine your applicable tax rate.

3. Employer Withheld ........................................................

,

,

.

0 0

4. TAX DUE: (line 2 minus line 3) ......................................

,

.

,

0 0

5. Penalty and Interest: Line 4 multiplied by

1.246% per month if paid after the due date ............

.

,

2 5

0 0

,

6. COST..............................................................................

.

7. TOTAL PAYMENT DUE (add lines 4 + 5 +6 ) ...........

,

,

0 0

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by calling Berkheimer at

610-599-3139, during the hours of 8:00 a.m. through 4:00 p.m., Monday through Friday. Or, you can visit our website at

Berkheimer is not the appointed tax hearing officer for your taxing district and will not accept any petitions for appeal. Petitions for appeal must be filed with the appropriate appeals

board for your County. Berkheimer can provide you with the proper procedures and forms necessary to file an appeal with the appeals board for your Tax Collection District.

DQ-1-REMINDER

If you moved enter the effective date: ____/____/______

Name

Check here if address change also applies to spouse

Address

DQ1R

City

OVERDUE QUARTER:

1

2

3

4

State

PERIOD COVERED:

January 1 thru March 31

April 1 thru June 30

&

Zip

July 1 thru September 30

October 1 thru December 31

1. Earned Income and/or net profits

.

,

0 0

,

(Must enter amount) .................................................

REMIT TO:Berkheimer Tax Administrator

PO Box 25154 Lehigh Valley, PA 18002-5154

.

,

0 0

,

2. Tax Rate multiplied by line 1 .....................................

Resident PSD Code

Work Location PSD Code

*See instructions on how to compute the tax

,

,

.

0 0

3. Employer Withheld ....................................................

,

,

.

0 0

RESIDENT MUNICIPALITY:

4. TAX DUE: (line 2 minus line 3) ...................................

5. Penalty and Interest: Line 4 multiplied by

,

,

.

0 0

If you have no earned income, state the reason: retired/homemaker/

1.246% per month if paid after the due date ............

.

student/disabled/temporarily unemployed/minor (state age)/other

2 5 0 0

,

,

6. COST.........................................................................

(please specify)

.

,

0 0

,

Check here if ALL tax is withheld by employer(s).

7. TOTAL PAYMENT DUE (add lines 4 + 5 +6 ) ...........

Do not complete information requested on Lines 1 thru 6.

HAB-EIT

Payable to:

PLEASE ENTER SOCIAL SECURITY NUMBER:

WE

Print Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1