Form Dq-1 - Quarterly Estimated Earned Income Tax - Berkheimer Tax Administrator

ADVERTISEMENT

I134

10/01

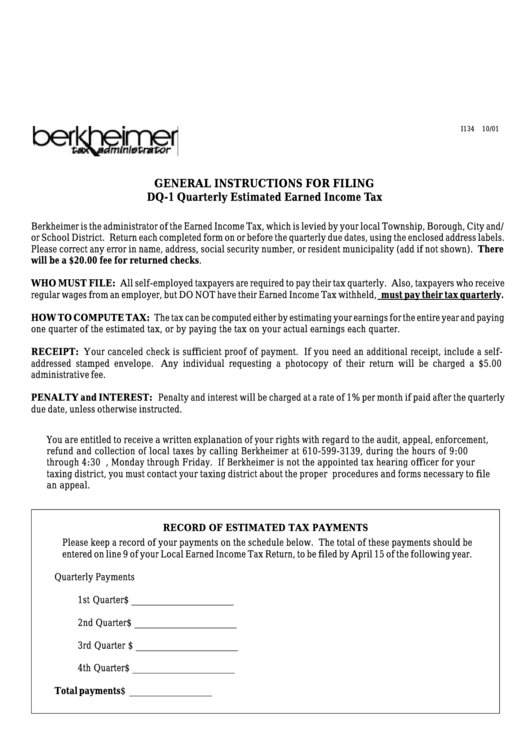

GENERAL INSTRUCTIONS FOR FILING

DQ-1 Quarterly Estimated Earned Income Tax

Berkheimer is the administrator of the Earned Income Tax, which is levied by your local Township, Borough, City and/

or School District. Return each completed form on or before the quarterly due dates, using the enclosed address labels.

Please correct any error in name, address, social security number, or resident municipality (add if not shown). There

will be a $20.00 fee for returned checks.

WHO MUST FILE: All self-employed taxpayers are required to pay their tax quarterly. Also, taxpayers who receive

regular wages from an employer, but DO NOT have their Earned Income Tax withheld, must pay their tax quarterly.

HOW TO COMPUTE TAX: The tax can be computed either by estimating your earnings for the entire year and paying

one quarter of the estimated tax, or by paying the tax on your actual earnings each quarter.

RECEIPT: Your canceled check is sufficient proof of payment. If you need an additional receipt, include a self-

addressed stamped envelope. Any individual requesting a photocopy of their return will be charged a $5.00

administrative fee.

PENALTY and INTEREST: Penalty and interest will be charged at a rate of 1% per month if paid after the quarterly

due date, unless otherwise instructed.

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement,

refund and collection of local taxes by calling Berkheimer at 610-599-3139, during the hours of 9:00 a.m.

through 4:30 p.m., Monday through Friday. If Berkheimer is not the appointed tax hearing officer for your

taxing district, you must contact your taxing district about the proper procedures and forms necessary to file

an appeal.

RECORD OF ESTIMATED TAX PAYMENTS

Please keep a record of your payments on the schedule below. The total of these payments should be

entered on line 9 of your Local Earned Income Tax Return, to be filed by April 15 of the following year.

Quarterly Payments

1st Quarter .......................................................................

$ _____________________

2nd Quarter ......................................................................

$ _____________________

3rd Quarter ......................................................................

$ _____________________

4th Quarter .......................................................................

$ _____________________

Total payments ............................................................................................

$ _________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1