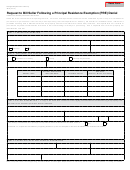

Form 4614 - Principal Residence Exemption Denials By The Michigan Department Of Treasury Faq Page 2

ADVERTISEMENT

4614, page 2

11.

How will I know the result of the appeal review by the PRE staff, if they determine that insufficient evidence

was provided to rule in my favor?

If your documentation does not show that the property was occupied as the owner’s principal residence, a letter will be sent to you advising

that your file will be forwarded to the Hearings Division for an informal conference. That office will notify you of the date, time, and place

of the informal conference.

12.

What if I disagree with the ruling of the Hearings Division?

You may appeal the decision of the Hearings Division to the Small Claims Division of the Michigan Tax Tribunal.

13.

What if the property was foreclosed upon and is now owned by a mortgage company or some other

business?

In order for property to qualify for the PRE, the owner must be a living person(s) who holds legal title to the parcel. A partnership, corporation,

limited liability company, association, or other legal entity does not meet the requirements of an “owner” as defined by MCL 211.7dd. In addition,

if the owner, prior to foreclosure, did not occupy the property as his or her principal residence, the additional tax, penalty and interest for those

years would become a lien against the property since valuable consideration was not given for the property.

14.

Do I have to pay additional taxes before I can appeal?

No. Taxes do not have to be paid at the time of the appeal. However, penalty and interest will continue to accrue. If your appeal is not

successful and the denial is upheld, the penalty and interest will be charged from the original due date of the taxes.

15.

How can I find out how much my adjusted bill is/will be?

You will receive a bill for corrected or adjusted taxes by mail. Depending on your specific circumstances, the bill can come from either

the Department or your local or county treasurer. You may contact your local or county treasurer to obtain the amount of the corrected or

adjusted taxes if a bill has not yet been received.

16.

Can I have any interest or penalties waived?

The General Property Tax Act does not provide a provision for waiver of interest.

17.

Can I make a partial payment?

Most counties and local units require full payment. If a taxpayer is allowed to make a partial payment, any funds received will first be

applied to penalties and interest. The remainder of taxes owed will continue to accumulate interest and may result in a lien against the

property.

18.

Why was my PRE denied on my parcel of land next to my home?

Generally, land adjoining or contiguous to a person’s principal residence qualifies for a PRE if that person owns the adjoining or contiguous

parcel(s). However, the adjoining or contiguous parcel must be classified as residential and be unoccupied to qualify for the exemption.

19.

Why did I receive a PRE denial on my agricultural property?

The Department does not review Qualified Agricultural Exemptions. However, because a Qualified Agricultural Exemption results in

the same tax savings as a PRE, some assessors place a PRE on agricultural property. If a valid agricultural exemption exists and covers

the years at issue, that exemption on the parcel(s) will remain unchanged. The assessor should be contacted to fix the discrepancy and the

Department should be notified in accordance with the appeal process explained in the denial notice.

20.

Why was I denied and billed for years that I did not own the property?

The Department was unable to verify that you did not own the property for all of the years denied. In addition, the county and local unit

may not have been aware of the discrepancy at the time of billing. The best way to make the correction is to proceed with the appeal

process by providing documentation that you did not own the property for the specific years. The county treasurer and local unit will be

informed of the results of the appeal.

21.

I received the denial notice and didn’t realize what it was until I received the additional tax bill. Now it’s

well after the 35 days to appeal. What can I do?

MCL 211.7cc gives the taxpayer 35 days to appeal a denial from the date the denial was received. There is nothing in the statute to allow

the Department to give you additional time if the denial was received.

22.

I did not receive the denial notice, but received the additional tax bill. Now it’s well after the 35 days to

appeal. What can I do?

MCL 211.7cc gives the taxpayer 35 days to appeal a denial from the date the denial was received. There is nothing in the statute to allow the

Department to give you additional time if the denial was received. You may send in an appeal beyond the 35 days, detailing why the denial

notice was not received. The information provided in your appeal will be reviewed and you will be notified in writing of the Department’s

decision.

23.

Where can I find more information about PREs?

Information regarding PREs is found at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2