Household Payroll Employer Worksheet

ADVERTISEMENT

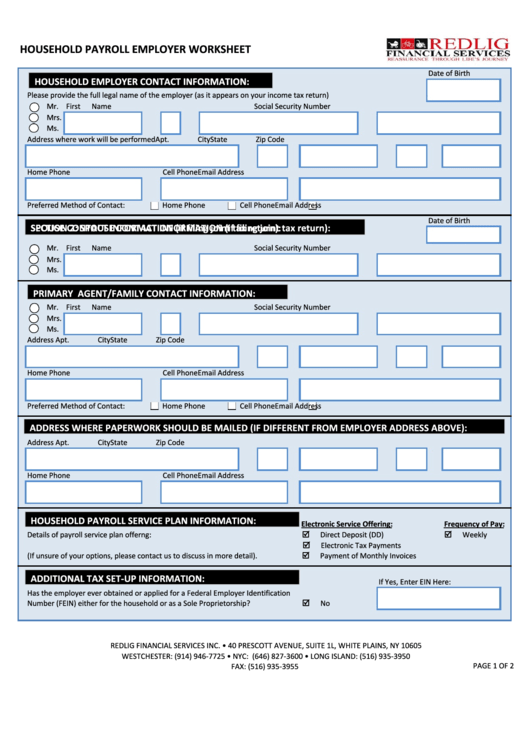

HOUSEHOLD PAYROLL EMPLOYER WORKSHEET

Date of Birth

HOUSEHOLD EMPLOYER CONTACT INFORMATION:

Please provide the full legal name of the employer (as it appears on your income tax return)

Mr. First Name

M.I.

Last Name

Social Security Number

Mrs.

Ms.

Address where work will be performed

Apt.

City

State

Zip Code

Home Phone

Cell Phone

Email Address

Preferred Method of Contact:

Home Phone

Cell Phone

Email Address

Date of Birth

SPOUSE CONTACT INFORMATION (if filing joint tax return):

SECTION 2: SPOUSE CONTACT INFORMATION (if filing joint tax return):

Mr. First Name

M.I.

Last Name

Social Security Number

Mrs.

Ms.

PRIMARY AGENT/FAMILY CONTACT INFORMATION:

Mr. First Name

M.I.

Last Name

Social Security Number

Mrs.

Ms.

Address

Apt.

City

State

Zip Code

Home Phone

Cell Phone

Email Address

Preferred Method of Contact:

Home Phone

Cell Phone

Email Address

ADDRESS WHERE PAPERWORK SHOULD BE MAILED (IF DIFFERENT FROM EMPLOYER ADDRESS ABOVE):

Address

Apt.

City

State

Zip Code

Home Phone

Cell Phone

Email Address

HOUSEHOLD PAYROLL SERVICE PLAN INFORMATION:

Electronic Service Offering:

Frequency of Pay:

Details of payroll service plan offerng:

Direct Deposit (DD)

Weekly

Electronic Tax Payments

(If unsure of your options, please contact us to discuss in more detail).

Payment of Monthly Invoices

ADDITIONAL TAX SET‐UP INFORMATION:

If Yes, Enter EIN Here:

Has the employer ever obtained or applied for a Federal Employer Identification

Number (FEIN) either for the household or as a Sole Proprietorship?

No

REDLIG FINANCIAL SERVICES INC. • 40 PRESCOTT AVENUE, SUITE 1L, WHITE PLAINS, NY 10605

WESTCHESTER: (914) 946‐7725 • NYC: (646) 827‐3600 • LONG ISLAND: (516) 935‐3950

PAGE 1 OF 2

FAX: (516) 935‐3955

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2