Penalty Waiver Request Form - City Of Auburn Alabama Page 2

ADVERTISEMENT

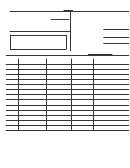

PENALTY WAIVER REQUEST FORM

Page 2

INSTRUCTIONS TO COMPLETE FORM

Section 1 – Business Information – This section should identify the business/taxpayer who received the penalty

assessment. Information should agree with the business information coded in the Revenue tax/licensing system as

provided on the business registration form.

Section 2 – Tax/Licensing Penalty Type – This section should identify:

• tax/licensing fee type on which the penalty was assessed

• amount of the penalty

• tax/licensing period covered for which the penalty was assessed

A copy of the penalty invoice/assessment should be submitted along with this request form.

Section 3 – Reason For Request of Waiver – This section outlines the three acceptable reasons for which a waiver of

11-51-93(c) of Code of Alabama, 1975

penalties may be granted under Section

. An explanation must be provided to

show how event prevented compliance with city ordinances and codes (attach additional sheets if needed). Sufficient and

detailed documentation should accompany the request to support basis of reasonable cause and grounds for waiver.

GENERAL INFORMATION

• Waiver request will be processed within 30 days of receipt of form and supporting documentation

• Written notification of approval or denial will be mailed to address coded in the tax/licensing system

• Waiver of assessed penalties totaling $1,000 or more require City Council approval

o All waiver request submitted to Council for approval will be placed on the Council agenda which is

public information

o Your signature consent will be requested prior to placement of waiver request on Council agenda; failure

to provide signature consent may result in the delay and/or denial of request

• Waiver request does not cover the waiver of interest assessed for untimely filing. Section 40-1-44 of Code of

Alabama, 1975 does not allow the waiving of interest

o If a waiver of penalties is granted, you will be invoiced for the remaining interest assessment

• If waiver request is denied, you have thirty (30) days from the date of denial to file an appeal. Appeals must be

made in writing. Appeals should be mailed to:

City of Auburn-Revenue Office

Attention: Finance Director

144 Tichenor Avenue, Suite 6

Auburn, Alabama 36830

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2