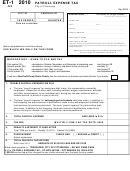

Form Pt 2011 - Parking Tax - City Of Pittsburgh - 2010 Page 3

ADVERTISEMENT

GENERAL PARKING TAX FILING INSTRUCTIONS

1. Tax Rate - originally enacted as Ordinance 566 of 1967, and amended by Ordinance 674

of 1968, Ordinance 704 of 1969, Ordinance 52 of 1981, Ordinance 58 of 1991, Ordinance

40 of 1997, Ordinance 43 of 2003 and Ordinance 1 of 2004. Any tax due for the period

from January 1, 1963 through December 31, 1968, is imposed at the rate of ten per cent

(10%); for the period January 1, 1969 through December 31 1969, the tax rate is fifteen

percent (15%); for the period January 1, 1970 through December 31, 1981, the tax rate is

twenty percent (20%); for the period January 1, 1982 through December 31, 1991, the tax

rate is twenty-five percent (25%); for period January 1, 1992 through December 31, 1997

the rate is twenty-six percent (26%); for period January 1, 1998 through January 31,

2004, the tax rate is thirty-one (31%); and subsequent to February 1, 2004, the tax rate is

fifty-percent (50%). Act 222 (H.B. 197) of 2004 provides that the parking tax rate in tax

year 2007 shall not exceed 45%; 40% in 2008; 37.5% in 2009; and 35% in 2010 - Act 44

(HB1828) of 2009 allows the tax to stay at the thirty seven and one half percent

(37.5%) rate in 2010 and increase it to forty (40%) percent if certain conditions are

met for future years. The rate of tax may be changed for any tax year by legislative

actions of the Mayor and City Council. Therefore, it is advisable to check Section 253.02

of the Pittsburgh Code to determine the effective rate for the current tax year.

2. The City of Pittsburgh imposes a tax upon each parking transaction by a patron of a

nonresidential parking place.

3. No operator shall begin or continue to conduct the operation of a nonresidential parking

place without registering with the City Treasurer 412-255-8603 and obtaining an annual

license with the Bureau of Building Inspection 412-255-2858 for each parking place.

4. Each operator shall maintain, separately, with respect to each parking place, the total

amount of consideration received from all transactions, and the amount of tax collected

on the basis of such consideration.

5. Operators shall collect the tax imposed by this ordinance and shall be liable to the City of

Pittsburgh as agent thereof for payment to the City Treasurer.

th

6. Each operator, on forms prescribed by the Treasurer, shall file by the (15

) fifteenth day

of each month, a return for the preceding month’s collections, disclosing information as is

required in the filing of the PT form.

7. The PT Form requires the reporting of daily starting and finishing ticket numbers and the

ticket colors.

8. TOTAL GROSS COLLECTIONS (Line 6), should be the sum of each separate category,

i.e., Day, Night, Event and Lease, and is to be reported on a daily basis on the reverse

side of the PT Form.

THIS RETURN MUST BE FILED WITH THE TREASURER, CITY OF PITTSBURGH, ON

OR BEFORE THE DATE INDICATED WITH REMITTANCE IN FULL FOR THE AMOUNT

OF TAXES DUE TO AVOID THE IMPOSITION OF PENALTIES AND INTEREST.

FAILURE TO FILE MAY RESULT IN LEGAL ACTION BY THE TREASURER’S OFFICE.

PENALTY LIMIT: 50% (.50)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3