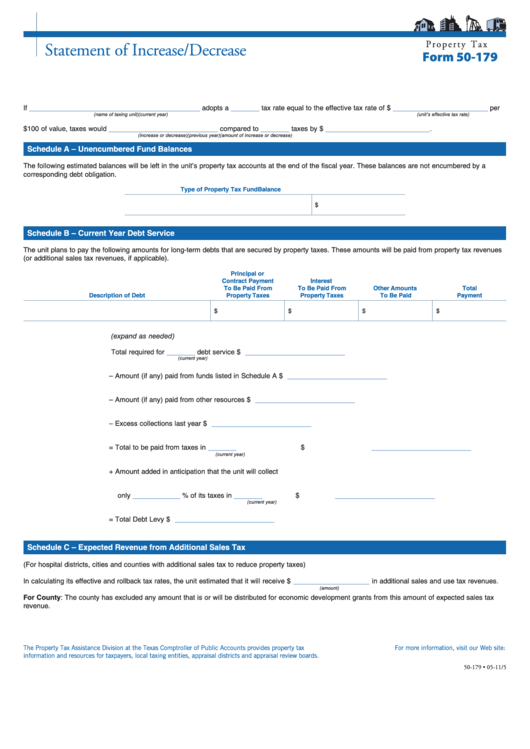

P r o p e r t y T a x

Statement of Increase/Decrease

Form 50-179

____________________________________

______

____________________

If

adopts a

tax rate equal to the effective tax rate of $

per

(name of taxing unit)

(current year)

(unit’s effective tax rate)

_______________________

______

______________________

$100 of value, taxes would

compared to

taxes by $

.

(increase or decrease)

(previous year)

(amount of increase or decrease)

Schedule A – Unencumbered Fund Balances

The following estimated balances will be left in the unit’s property tax accounts at the end of the fiscal year. These balances are not encumbered by a

corresponding debt obligation.

Type of Property Tax Fund

Balance

$

Schedule B – Current Year Debt Service

The unit plans to pay the following amounts for long-term debts that are secured by property taxes. These amounts will be paid from property tax revenues

(or additional sales tax revenues, if applicable).

Principal or

Contract Payment

Interest

To Be Paid From

To Be Paid From

Other Amounts

Total

Description of Debt

Property Taxes

Property Taxes

To Be Paid

Payment

$

$

$

$

(expand as needed)

______

_____________________

Total required for

debt service

$

(current year)

_____________________

–

Amount (if any) paid from funds listed in Schedule A

$

_____________________

–

Amount (if any) paid from other resources

$

_____________________

–

Excess collections last year

$

______

_____________________

=

Total to be paid from taxes in

$

(current year)

+

Amount added in anticipation that the unit will collect

__________

______

_____________________

only

% of its taxes in

$

(current year)

_____________________

=

Total Debt Levy

$

Schedule C – Expected Revenue from Additional Sales Tax

(For hospital districts, cities and counties with additional sales tax to reduce property taxes)

________________

In calculating its effective and rollback tax rates, the unit estimated that it will receive $

in additional sales and use tax revenues.

(amount)

For County: The county has excluded any amount that is or will be distributed for economic development grants from this amount of expected sales tax

revenue.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-179 • 05-11/5

1

1 2

2