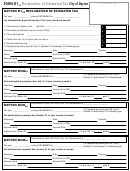

Form D1-I - Dayton Individual/joint Filing Declaration Of Estimated Tax - 2006 Page 2

ADVERTISEMENT

nd

DAYTON DCM 2

ESTIMATED INDIVIDUAL TAX PAYMENT

2006

Tax year

ending DECEMBER or _____________

nd

2

estimated tax payment due July 31 , of the year the income is earned.

Estimated full year TAX DUE (from declaration) $_________

__________________ Check here if amended

Name ________________________ Account # or SS# ___________________

Spouses name__________________ Account # or SS# _______________________

Address _______________________ City, State, Zip_________________________

22.5% due July 31, Paid

$___________

Make Checks Payable to the City Of Dayton, and Mail to City of Dayton, PO Box 634747, Cincinnati, Oh 45263-4747.

In the event your check is returned unpaid for insufficient funds or uncollected funds, we may electronically debit your account for the principal amount of the check

___________________________________ cut here _____________________________________

rd

DAYTON DCM 3

ESTIMATED INDIVIDUAL TAX PAYMENT

2006

Tax year

ending DECEMBER or _____________

rd

3

estimated tax payment due October 31 , of the year the income is earned...

Estimated full year TAX DUE (from declaration) $________

__________________ Check here if amended

Name ________________________ Account # or SS# ______________________

Spouses name__________________ Account # or SS# __________________________

_________________

_____________________

Address

City, State, Zip

22.5% due October 31, Paid

$______________

Make Checks Payable to the City Of Dayton, and Mail to City of Dayton, PO Box 634747, Cincinnati, Oh 45263-4747.

In the event your check is returned unpaid for insufficient funds or uncollected funds, we may electronically debit your account for the principal amount of the check

_______________________________________________

__________________________________________________

cut here

th

DAYTON DCM 4

ESTIMATED INDIVIDUAL TAX PAYMENT

2006

Tax year

ending DECEMBER or _____________

4th estimated tax payment due January 31 , of the following the year the income is earned .

Estimated full year TAX DUE (from declaration) $________

__________________ Check here if amended

Name ________________________ Account # or SS# ____________________

Spouses name__________________ Account # or SS# ________________________

Address _______________________ City, State, Zip___________________________

22.5% due January 31, Paid

$_____________

Make Checks Payable to the City Of Dayton, and Mail to City of Dayton, PO Box 634747, Cincinnati, Oh 45263-4747

In the event your check is returned unpaid for insufficient funds or uncollected funds, we may electronically debit your account for the principal amount of the check

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2