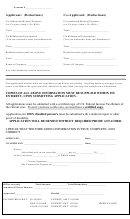

Application For Tax Exemption Form Page 2

ADVERTISEMENT

Account # ____________________

Applicant: (Deductions)

Co-Applicant: (Deductions)

Un reimbursed Medical Expenses

Un reimbursed Medical Expenses

(ex. Co-pays, exam’s, Dr. Bills)

(ex. Co-pays, exam’s, Dr. Bills)

Total: _________________________

Total: _____________________________

Un Reimbursed Prescriptions

UN Reimbursed Prescriptions

(You can obtain this from your Pharmacist)

(You can obtain this from your Pharmacist)

Total: ____________________________

Total: ______________________________

Health Insurance paid out of pocket:

Health Insurance paid out of pocket:

Total: ____________________________

Total: __________________________________

Name of Company: __________________

Name of Company: _________________________

Any other deductions can be listed below;

This application must be filled out completely to the best of your ability. Anything that may not apply to you

please write N/A in the space provided, otherwise we may think you forgot to include some information.

COPIES OF ALL ABOVE INFORMATION MUST BE SUPPLIED WITHIN ITS

ENTIRETY, UPON SUBMITTING APPLICATION.

All applications must be submitted with a certified copy of U.S. Federal Income Tax Return of

the current year. Even if you have to file zero, we must have a certified copy.

Applications for 100% disabled person’s must be submitted with a medical report or other

proof of disability.

APPLICATION WILL BE DENIED WITHOUT REQUIRED PROOF ATTACHED.

I SWEAR THAT THE FORE GOING INFORMATION IS TRUE, COMPLETE, AND

CORRECT.

APPLICANT: _______________________________________________________

Date: _______________________

CO APPLICANT: _____________________________________________________

Date: _______________________

Notary:

Subscribed and sworn to me this _________day of______________20______

In the (city/town) ___________________or Rhode Island.

Notary Signature: _______________________________________________

My Commission Expires on: ____________

Office use only

Total income: ___________ Total Deductions ______________

Amount of Gross Income: _____________________________

Approved ____________________

Denied__________________________________

INCOME BRACKET: $0--$8,000

EXEMPT. AMT. $10,000

<

$8001-$10,000

EXEMPT AMT. $7,000

CIRCLE ONE!

$10,001-$15,000

EXEMPT AMT $5,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2