Form 15g - Declaration Under Section 197(A)1 And Section 197a(1a) Of The Income Tax Act, 1961 To Be Made By An Individual Or A Person (Not Being A Company Or A Firm) Claiming Certain Receipts Without Deduction Of Tax Page 3

ADVERTISEMENT

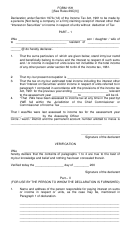

SCHEDULE IV

(Details of the mutual fund units held in the name of declarant and beneficially owned by him)

Name and address of

Number of

Class of units and

Distinctive number

Income in respect

the Mutual Fund

units

face value of each

of units

of units

unit

SCHEDULE V

(Details of the withdrawal made from National Saving Scheme)

Particulars of the Post Office where the account

Date on which the

The amount of withdrawal

under the National Savings Scheme is

account was opened

from the account

maintained and the account number

Signature of the declarant

Declaration/ Verification

*I/We_______________do hereby declare that to the best of *my/our knowledge and belief what is stated above

is correct, complete and is truly stated. *i/We declare that the incomes referred to in this form are not includible in

the total income of any other person u/s 60 to 64 of the income tax act, 1961. *I/We further declare that the tax

on *my/our estimated total income, including *income/incomes referred to in column 22 above, computed in

accordancewith the provisions of the income tax act, 1961 for the previous year ending on ____________ relevant

to the assessment year ___________will not exceed the maximum amount which is not chargeable to income tax.

Place:

Date:

Signature of Declarant

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5