Form 15g - Declaration Under Section 197(A)1 And Section 197a(1a) Of The Income Tax Act, 1961 To Be Made By An Individual Or A Person (Not Being A Company Or A Firm) Claiming Certain Receipts Without Deduction Of Tax Page 4

ADVERTISEMENT

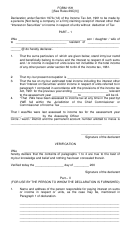

Part II

(For use by the person to whom the declaration is furnished)

1. Name of the person responsible for paying the income referred to in column 22 of part I

2. PAN of the person indicated in column 1 of Part II

3. Complete Address

4. TAN of the person indicated in column 1 of Part II

5. Email

6. Telephone No. with STD Code and mobile no.

7. Status

8. Date on which declaration is furnished (dd/mm/yy)

9. Period in respect of which the dividend has been declared or the income has been paid/credited

10. Amount of income paid

11. Date on which the income has been paid/credited (dd/mm/yy)

12. Date of declaration, distribution or payment of dividend/withdrawal under the NSS (dd/mm/yy)

13. Account Number of Nss from which withdrawal has been made

Forwarded to the chief commissioner or commissioner of income tax ……………………………………………………..

Place :

Date:

Signature of the person responsible for

paying the income referred to in column 22 of Part I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5