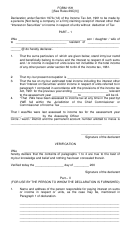

Form 15g - Declaration Under Section 197(A)1 And Section 197a(1a) Of The Income Tax Act, 1961 To Be Made By An Individual Or A Person (Not Being A Company Or A Firm) Claiming Certain Receipts Without Deduction Of Tax Page 5

ADVERTISEMENT

Notes:

1. The declaration should be furnished in duplicate

2. Delete whichever is not applicable.

3. Declaration can be furnished by an individual under section 197A(1) and a person (other than a company

or a firm) u/s 197A(1A).

4. Indicate the capacity in which the declaration is furnished on behalf of a HUF, AOP etc.

5. Before signing the declaration/verification, the declarant should satisfy himself that the information

furnished in this form is true, correct and complete in all respects. Any person making a false statement in

the declaration shall be liable to prosecution u/s 277 of the income tax act, 1961 and on conviction be

punishable:

(i)

in a case where tax sought to be evaded exceeds one lakh rupees, with rigorous

imprisonment which shall not be less than six months but which may extend to seven years

and with fine;

(ii)

in any other case, with rigorous imprisonment which shall not be less than three months but

which may extend to the two years and with fine.

6. The person responsible for paying the income referred to in column 22 of Part I shall not accept the

declaration where the amount of income of the nature referred to in sub-section (1) or sub-section (1A) of

section 197A or the aggregate of the amounts of such income credited or paid or likely to be credited or

paid during the previous year in which such income is to be included exceed the maximum amount which

is not chargeable to tax;

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5