Bmo Funds Ira Distribution Form Page 4

Download a blank fillable Bmo Funds Ira Distribution Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Bmo Funds Ira Distribution Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

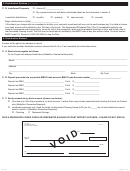

5. Federal and/or State Withholding Election

Distributions from your BMO Funds IRA are subject to federal income tax withholding unless you elect not to have withholding apply. In

addition, certain states also require state income tax withholding. We will withhold on your entire distribution (including any portion that

may relate to nondeductible IRA contributions) unless you otherwise elect below. You may elect not to have withholding apply. You may be

responsible for paying estimated tax if you elect not to have withholding apply or if you do not have enough income tax withheld from your

distribution. You may incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient.

If you fail to make an election, federal and, if applicable, state income tax will be withheld from your distribution. Federal income

tax will be withheld from payments at the rate of 10% if no election is made.

Federal: o I do not want federal income taxes withheld from my distribution.

o I do want federal income taxes withheld from my distribution in the amount of ________% or $ _____________.

State Income Tax Withholding: Applicable only to AR, CA, DC, DE, IA, KS, ME, MA, MI, MS, NE, NC, OK, OR, VT, VA. In most cases, if

federal taxes are withheld, mandatory, tax withholding will apply, unless you check one of the boxes below. Some states have additional

provisions in order to opt out of automatic state tax withholding (e.g. Michigan) Consult with your tax advisor or refer to your state’s tax laws

for more information.

State:

o I do not want state income taxes withheld from my distribution.

o I do want state income taxes withheld from my distribution in the amount of $ _____________.

(Refer to your state for minimum withholding amount)

6. Signature

I understand that a $10 maintenance fee per fund may be collected by redeeming sufficient shares from my account if I have not prepaid the

fee for this calendar year.

I certify the accuracy of the distribution reason selected above and I authorize the transaction. I agree to the terms of this form. I understand

that I am responsible for any consequences resulting from this distribution including taxes and penalties owed. I agree to indemnify and to

hold the Custodian/Trustee harmless from any tax penalty or other liability resulting from this distribution. I acknowledge that the Custodian/

Trustee cannot provide legal advice and I agree to consult with my own tax professional if I need advice.

___________________________________________________________________________

_________________________________

Signature of IRA Owner

Date

Medallion Guarantee

A medallion guarantee is required for any distribution which is either:

• sent to an address different from the address listed on the account statement, or

• made payable to someone other than the account owner, or

• sent to the address of record, if changed within the last 30 days, or

• sent to a bank account.

You may obtain a Medallion Guarantee from any guarantor institution, as defined by FINRA. These institutions include commercial banks,

savings associations, trust companies and brokerage firms that participate in the program. The words “Medallion Guaranteed” along with the

name of the guarantor institution must be stamped on this form and appear with the signature of an authorized person. Please note that a

Notary Public is different from a Medallion Guarantee and is not acceptable.

7. Mailing Information

Regular Mail:

Overnight Mail:

BMO Funds

BMO Funds

P.O. Box 55931

c/o Boston Financial Data Services

Boston, MA 02205-5931

Suite 55931

30 Dan Rd.

Canton, MA 02021

(6/14)

Page 4 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4