Form Le-3r - Liquor Enforcement Tax Return

ADVERTISEMENT

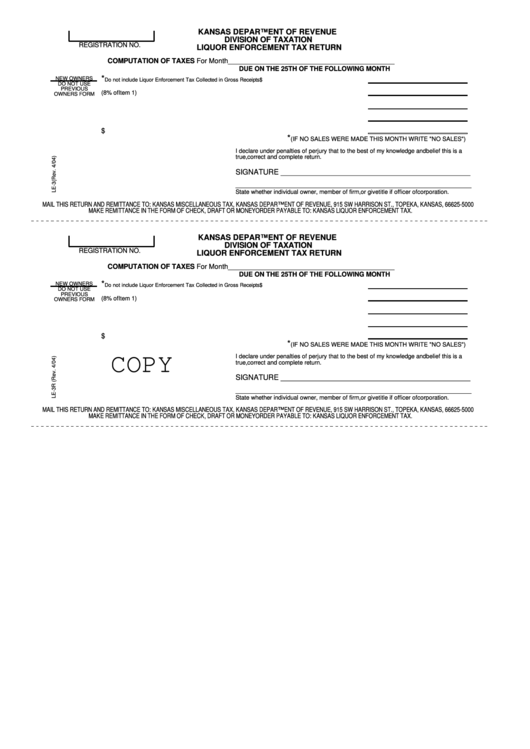

KANSAS DEPARTMENT OF REVENUE

DIVISION OF TAXATION

REGISTRATION NO.

LIQUOR ENFORCEMENT TAX RETURN

COMPUTATION OF TAXES For Month ___________________________________________

DUE ON THE 25TH OF THE FOLLOWING MONTH

*

NEW OWNERS

1. Total gross receipts for the month

Do not include Liquor Enforcement Tax Collected in Gross Receipts $

DO NOT USE

PREVIOUS

2. Amount of tax due for this month (8% of Item 1).....................................................................

OWNERS FORM

3. Penalty ...................................................................................................................................

4. Interest ...................................................................................................................................

$

5. Amount of remittance enclosed...............................................................................................

*

(IF NO SALES WERE MADE THIS MONTH WRITE "NO SALES")

I declare under penalties of perjury that to the best of my knowledge and belief this is a

true, correct and complete return.

SIGNATURE _____________________________________________

________________________________________________________

State whether individual owner, member of firm, or give title if officer of corporation.

MAIL THIS RETURN AND REMITTANCE TO: KANSAS MISCELLANEOUS TAX, KANSAS DEPARTMENT OF REVENUE, 915 SW HARRISON ST., TOPEKA, KANSAS, 66625-5000

MAKE REMITTANCE IN THE FORM OF CHECK, DRAFT OR MONEY ORDER PAYABLE TO: KANSAS LIQUOR ENFORCEMENT TAX.

KANSAS DEPARTMENT OF REVENUE

DIVISION OF TAXATION

REGISTRATION NO.

LIQUOR ENFORCEMENT TAX RETURN

COMPUTATION OF TAXES For Month ___________________________________________

DUE ON THE 25TH OF THE FOLLOWING MONTH

*

NEW OWNERS

1. Total gross receipts for the month

Do not include Liquor Enforcement Tax Collected in Gross Receipts $

DO NOT USE

PREVIOUS

2. Amount of tax due for this month (8% of Item 1).....................................................................

OWNERS FORM

3. Penalty ...................................................................................................................................

4. Interest ...................................................................................................................................

$

5. Amount of remittance enclosed...............................................................................................

*

(IF NO SALES WERE MADE THIS MONTH WRITE "NO SALES")

I declare under penalties of perjury that to the best of my knowledge and belief this is a

COPY

true, correct and complete return.

SIGNATURE _____________________________________________

________________________________________________________

State whether individual owner, member of firm, or give title if officer of corporation.

MAIL THIS RETURN AND REMITTANCE TO: KANSAS MISCELLANEOUS TAX, KANSAS DEPARTMENT OF REVENUE, 915 SW HARRISON ST., TOPEKA, KANSAS, 66625-5000

MAKE REMITTANCE IN THE FORM OF CHECK, DRAFT OR MONEY ORDER PAYABLE TO: KANSAS LIQUOR ENFORCEMENT TAX.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2