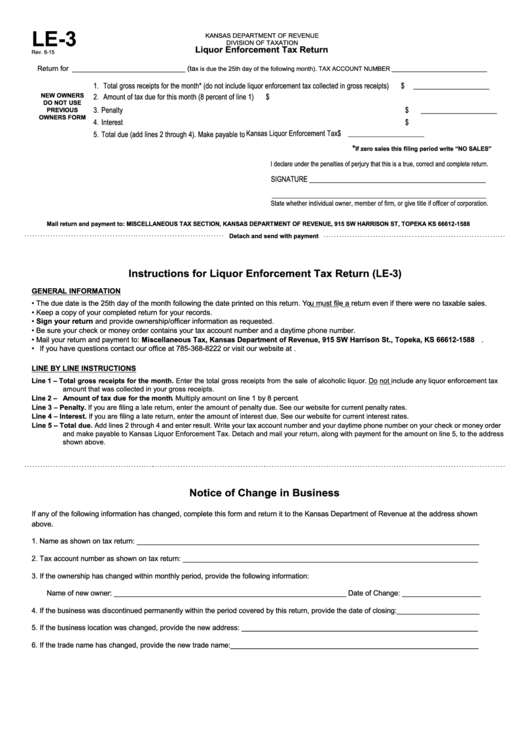

LE-3

KANSAS DEPARTMENT OF REVENUE

DIVISION OF TAXATION

Liquor Enforcement Tax Return

Rev. 8-15

Return for _____________________________ (ta

x is due the 25th day of the following month). TAX ACCOUNT NUMBER ____________________________

1. Total gross receipts for the month* (do not include liquor enforcement tax collected in gross receipts)

......

$

______________________

NEW OWNERS

2. Amount of tax due for this month (8 percent of line 1)

....................................................................................

$

______________________

DO NOT USE

3. Penalty

..............................................................................................................................................................

$

______________________

PREVIOUS

OWNERS FORM

4. Interest

..............................................................................................................................................................

$

______________________

5. Total due (add lines 2 through 4). Make payable to Kansas Liquor Enforcement Tax

.................................

$

______________________

*

If zero sales this filing period write “NO SALES”

I declare under the penalties of perjury that this is a true, correct and complete return.

SIGNATURE ___________________________________________________

______________________________________________________________

State whether individual owner, member of firm, or give title if officer of corporation.

Mail return and payment to: MISCELLANEOUS TAX SECTION, KANSAS DEPARTMENT OF REVENUE, 915 SW HARRISON ST, TOPEKA KS 66612-1588

Detach and send with payment

Instructions for Liquor Enforcement Tax Return (LE-3)

GENERAL INFORMATION

• The due date is the 25th day of the month following the date printed on this return. You must file a return even if there were no taxable sales.

• Keep a copy of your completed return for your records.

• Sign your return and provide ownership/officer information as requested.

• Be sure your check or money order contains your tax account number and a daytime phone number.

• Mail your return and payment to: Miscellaneous Tax, Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66612-1588.

• If you have questions contact our office at 785-368-8222 or visit our website at .

LINE BY LINE INSTRUCTIONS

Line 1 – Total gross receipts for the month. Enter the total gross receipts from the sale of alcoholic liquor. Do not include any liquor enforcement tax

amount that was collected in your gross receipts.

Line 2 – Amount of tax due for the month. Multiply amount on line 1 by 8 percent.

Line 3 – Penalty. If you are filing a late return, enter the amount of penalty due. See our website for current penalty rates.

Line 4 – Interest. If you are filing a late return, enter the amount of interest due. See our website for current interest rates.

Line 5 – Total due. Add lines 2 through 4 and enter result. Write your tax account number and your daytime phone number on your check or money order

and make payable to Kansas Liquor Enforcement Tax. Detach and mail your return, along with payment for the amount on line 5, to the address

shown above.

Notice of Change in Business

If any of the following information has changed, complete this form and return it to the Kansas Department of Revenue at the address shown

above.

1.

Name as shown on tax return: _______________________________________________________________________________________

2.

Tax account number as shown on tax return: ___________________________________________________________________________

3.

If the ownership has changed within monthly period, provide the following information:

Name of new owner: ___________________________________________________________ Date of Change: ____________________

4.

If the business was discontinued permanently within the period covered by this return, provide the date of closing:_____________________

5.

If the business location was changed, provide the new address: ____________________________________________________________

6.

If the trade name has changed, provide the new trade name:_______________________________________________________________

1

1