Substitute For Form W-9 - Request For Taxpayer Id Number And Certification

ADVERTISEMENT

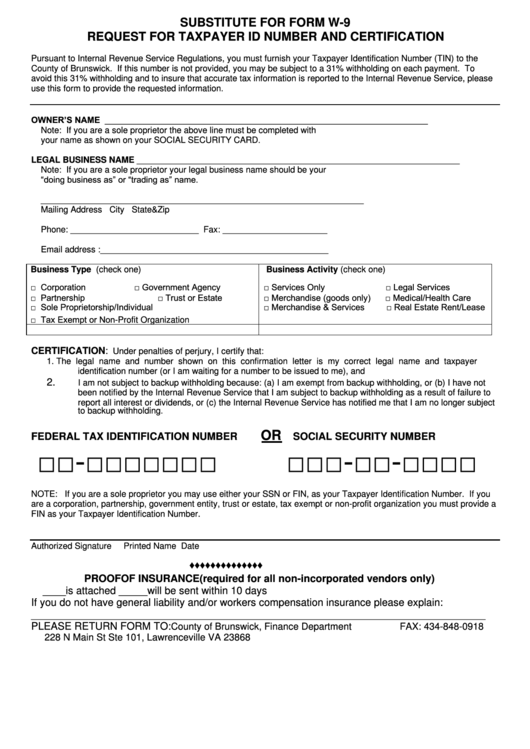

SUBSTITUTE FOR FORM W-9

REQUEST FOR TAXPAYER ID NUMBER AND CERTIFICATION

Pursuant to Internal Revenue Service Regulations, you must furnish your Taxpayer Identification Number (TIN) to the

County of Brunswick. If this number is not provided, you may be subject to a 31% withholding on each payment. To

avoid this 31% withholding and to insure that accurate tax information is reported to the Internal Revenue Service, please

use this form to provide the requested information.

OWNER’S NAME

____________________________________________________________________

Note: If you are a sole proprietor the above line must be completed with

your name as shown on your SOCIAL SECURITY CARD.

LEGAL BUSINESS NAME

____________________________________________________________________

Note: If you are a sole proprietor your legal business name should be your

“doing business as” or “trading as” name.

____________________________________________________________________

Mailing Address

City

State&Zip

Phone: ___________________________ Fax: ______________________

Email address :________________________________________________

Business Type (check one)

Business Activity (check one)

□ Corporation

□ Government Agency

□ Services Only

□ Legal Services

□ Partnership

□ Trust or Estate

□ Merchandise (goods only)

□ Medical/Health Care

□ Sole Proprietorship/Individual

□ Merchandise & Services

□ Real Estate Rent/Lease

□ Tax Exempt or Non-Profit Organization

CERTIFICATION:

Under penalties of perjury, I certify that:

1.

The legal name and number shown on this confirmation letter is my correct legal name and taxpayer

identification number (or I am waiting for a number to be issued to me), and

2.

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not

been notified by the Internal Revenue Service that I am subject to backup withholding as a result of failure to

report all interest or dividends, or (c) the Internal Revenue Service has notified me that I am no longer subject

to backup withholding.

OR

FEDERAL TAX IDENTIFICATION NUMBER

SOCIAL SECURITY NUMBER

□□-□□□□□□□

□□□-□□-□□□□

NOTE: If you are a sole proprietor you may use either your SSN or FIN, as your Taxpayer Identification Number. If you

are a corporation, partnership, government entity, trust or estate, tax exempt or non-profit organization you must provide a

FIN as your Taxpayer Identification Number.

Authorized Signature

Printed Name

Date

♦♦♦♦♦♦♦♦♦♦♦♦♦♦

PROOF OF INSURANCE (required for all non-incorporated vendors only)

____is attached

_____will be sent within 10 days

If you do not have general liability and/or workers compensation insurance please explain:

_______________________________________________________________________________

PLEASE RETURN FORM TO:

County of Brunswick, Finance Department

FAX: 434-848-0918

228 N Main St Ste 101, Lawrenceville VA 23868

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1