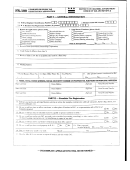

Form Reg-1 Draft - Business Taxes Registration Application Page 3

ADVERTISEMENT

8. Sales and Use Taxes

Yes

No

Do you sell, or will you be selling, goods in Connecticut (either wholesale or retail)? ...........................................

Yes

No

Do you rent equipment or other tangible personal property to individuals or businesses in Connecticut? ............

Yes

No

Do you serve meals or beverages in Connecticut? ................................................................................................

Do you provide a taxable service in Connecticut? See the Informational Publication,

Getting Started in Business, and the Special Notice on Legislative Changes Affecting the Sales

Yes

No

and Use Taxes, on the DRS website, for a list of taxable services ........................................................................

If you answered Yes to any of the sales and use taxes questions,

__ __ - __ __ - __ __

__ __

enter the date you will start selling or leasing goods or taxable services. ......................................

m

m

d

d

y

y

y

y

8a. Prepaid

Wireless E

9-1-1

Fee

Yes

No

Do you sell prepaid wireless

services

in Connecticut? ...........................................................................................

__ __ - __ __ - __ __

__ __

If you answered Yes, enter the date you will start to sell these in Connecticut. .............................

m

m

d

d

y

y

y

y

9. Room Occupancy Tax

Do you provide lodging rooms for rent in a hotel, motel, or rooming house in Connecticut

Yes

No

for 30 consecutive days or less? ............................................................................................................................

If you answered Yes, enter the date you will start to provide rooms for rent

__ __ - __ __ - __ __

__ __

for lodging purposes in Connecticut. ..............................................................................................

m

m

d

d

y

y

y

y

10. Business Entity Tax - Do not complete this section if the entity is liable for the corporation business tax.

The business entity tax applies to all of the following business types formed under Connecticut law and to those non-Connecticut

entities required to register with or obtain a certifi cate of authority from the Connecticut Secretary of the State before transacting

business in the state, whether or not the business has registered or fi led a certifi cate of authority, as the case may be, with the

Connecticut Secretary of the State.

•

S corporations (Qualifi ed subchapter S subsidiaries (QSSS) are not liable for the business entity tax.);

•

Limited liability companies (LLCs or SMLLCs) — any limited liability company that is, for federal income tax purposes, either:

•

Treated as a partnership if it has two or more members; or

•

Disregarded as an entity separate from its owner if it has a single member;

•

Limited liability partnerships (LLPs); and

•

Limited partnership (LPs).

Yes

No

Are you a business entity as described above? .....................................................................................................

__ __ - __ __ - __ __

__ __

Enter state you are organized under:

Enter date of organization. ......

________________________________

m

m

d

d

y

y

y

y

If not organized in Connecticut, enter the earlier of the date you started business in

__ __ - __ __ - __ __

__ __

Connecticut or the date you registered with the Connecticut Secretary of the State. ....................

m

m

d

d

y

y

y

y

Enter the month your tax year closes:

______________________________

11. Corporation

Business Tax or

Unrelated Business Income Tax

Corporation Business Tax

Do not complete this section if the entity is liable for the business entity tax.

Yes

No

Are you a

C

corporation? .......................................................................................................................................

Yes

No

Are you an LLC, SMLLC, or other association taxed as a

C

corporation? .............................................................

Yes

No

Is this corporation exempt from federal income tax? ..............................................................................................

Have you received a determination from the Internal Revenue Services (IRS) that this

Yes

No

corporation is exempt from federal income tax? ....................................................................................................

If Yes, enclose a copy of your IRS letter of determination.

__ __ - __ __ - __ __

__ __

Enter state you are organized under:

Enter date of organization . ...

_______________________________

m

m

d

d

y

y

y

y

If not a Connecticut corporation, enter the earlier of the date you started business in

__ __ - __ __ - __ __

__ __

Connecticut or the date you registered with the Connecticut Secretary of the State. ....................

m

m

d

d

y

y

y

y

Enter the month the corporate year closes:

________________________

Unrelated Business Income Tax

Are you a federally exempt organization that has unrelated business income

Yes

No

attributable to a trade or business in Connecticut? ................................................................................................

__ __ - __ __ - __ __

__ __

If you answered Yes, enter the date the unrelated business income tax liability started. ..............

m

m

d

d

y

y

y

y

Passive Investment Company (PIC)

Yes

No

Is this corporation a passive investment company as defi ned in Conn. Gen. Stat.§12-213(a)(27)? .....................

__ __ - __ __ - __ __

__ __

Enter the date the PIC was organized. ........................................................................................

m

m

d

d

y

y

y

y

Enter Connecticut tax registration number of the PIC’s related fi nancial service or insurance company:

___________________________________

Form REG-1 (Rev. 03/15)

Page 3 of 4

P:\Special\AFP\PROD\FORMS\15\REG\REG-1\REG-1 20150330.indd Last Modifi ed 2015330 02:37 PM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4