Form Reg-1 Draft - Business Taxes Registration Application Page 4

ADVERTISEMENT

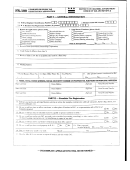

12. Business Use Tax

If you are registered for or are registering for sales and use taxes, you do not need to complete this section.

Business use tax is due when a business purchases taxable goods or services including the purchase or lease of assets,

consumable goods, and promotional items, for use in Connecticut without paying Connecticut sales tax.

Will you be purchasing taxable goods or services for use in Connecticut without

Yes

No

paying Connecticut sales tax? ................................................................................................................................

__ __ - __ __ - __ __

__ __

If you answered Yes to the business use tax question, enter the tax liability start date. ...............

m

m

d

d

y

y

y

y

If you answered No, you must complete the Business Use Tax Declaration section below.

Business Use Tax Declaration: By registering for any of the taxes listed in this application, you have indicated to the Department

of Revenue Services (DRS) that you may have a business use tax liability. Therefore, based on your application, you will be

automatically registered for the business use tax unless you complete the following declaration.

I,

(name of taxpayer or authorized representative of taxpayer), acknowledge I

__________________________________________________________

have read and understand the information concerning the business use tax and declare I will not be liable for business use tax.

Initial here.

_______________________________________________

13. Registration Fee Schedule

Enter the registration fee amount indicated. If you are liable for either sales and use taxes or room occupancy tax, or both, as

indicated in Sections 8 or 9, you must pay a $100 registration fee. Enter the appropriate registration fee(s) from Addendum A if you

are registering for the cigarette tax

and/or tabacco products

taxes. You must include the total registration fee due with Form REG-1

or your registration application will not be processed and will be returned.

Make your check payable to: Commissioner of Revenue Services. If you register by mail, send Form REG-1 with your payment to:

Department of Revenue Services, PO Box 2937, Hartford CT 06104-2937

Registration Fee

a. If registering for sales and use taxes or room occupancy tax, enter $100.* ......................... a.

b. If registering for cigarette tax

and/or tabacco products

taxes, see Addendum A. ................ b.

c. Total registration fee due: Add Line a and Line b. .................................................................. c.

* No fee is required for room occupancy tax if you are registered or are registering for sales and use taxes.

14. All Applicants Must Sign the Following Declaration

The application must be signed by the individual owner, partner, corporate offi cer, LLC member, or other person who has an executed

Power of Attorney with the authority to sign. Visit to download a Power of Attorney form. Complete and submit the

Power of Attorney form with this application.

I declare under penalty of law that I have examined this application and, to the best of my knowledge and belief, it is true, complete,

and correct. I understand the penalty for willfully delivering a false application to DRS is a fi ne of not more than $5,000, or imprisonment

for not more than fi ve years, or both.

Signature of owner, partner, LLC member, or corporate offi cer

Date

Telephone number

Sign here

(

)

and keep

a copy for

Print name of owner, partner, LLC member, or corporate offi cer

Title

your

records.

Form REG-1 (Rev. 03/15)

Page 4 of 4

P:\Special\AFP\PROD\FORMS\15\REG\REG-1\REG-1 20150330.indd Last Modifi ed 2015330 02:37 PM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4