Form Rr-210 - Gross Earnings Tax On Railroad Companies Page 3

ADVERTISEMENT

Enter company name _____________________________________________________

Enter Connecticut Tax Registration Number

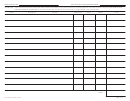

Schedule D

-

Enter a description of the Connecticut real estate owned by the taxpayer and not used exclusively in the railroad business. Also enter the amount of property taxes paid on such

real estate during the calendar year for which this return is filed. Do not enter any interest, fees, or charges related to such property taxes.

Date of

Assessed

Tax Rate

Amount

Owner

Description

Location

Assessment

Value

(Mills)

of Tax

Total

Form RR-210 (Rev. 12/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4