Form Bb-1 Instructions (Rev. 2007)

ADVERTISEMENT

Form BB-1 Instructions (Rev. 2007)

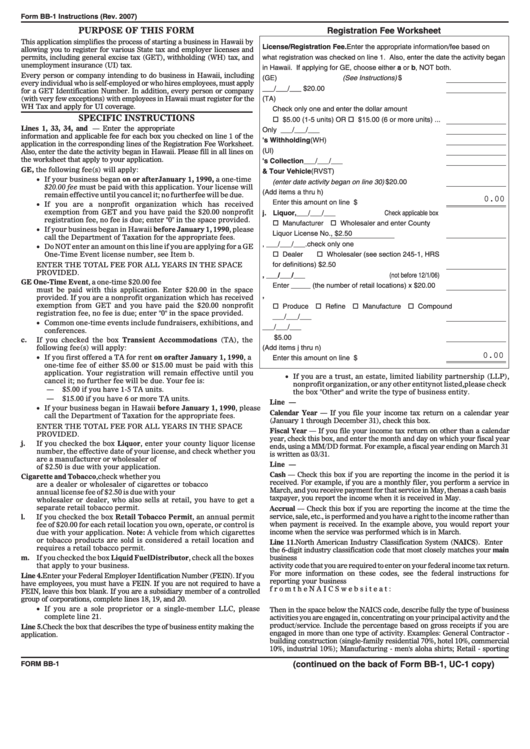

PURPOSE OF THIS FORM

Registration Fee Worksheet

This application simplifies the process of starting a business in Hawaii by

License/Registration Fee. Enter the appropriate information/fee based on

allowing you to register for various State tax and employer licenses and

permits, including general excise tax (GET), withholding (WH) tax, and

what registration was checked on line 1. Also, enter the date the activity began

unemployment insurance (UI) tax.

in Hawaii. If applying for GE, choose either a or b, NOT both.

Every person or company intending to do business in Hawaii, including

a. General Excise (GE) (See Instructions) .....................

$

every individual who is self-employed or who hires employees, must apply

b. GE One-Time Event ___/___/___...........Enter $20.00

for a GET Identification Number. In addition, every person or company

(with very few exceptions) with employees in Hawaii must register for the

c. Transient Accommodations (TA)

WH Tax and apply for UI coverage.

Check only one and enter the dollar amount

SPECIFIC INSTRUCTIONS

o $5.00 (1-5 units) OR o $15.00 (6 or more units) ...

Lines 1, 33, 34, and 35. Registration Fees — Enter the appropriate

d. Use Tax Only ___/___/___.................No fee required

-0-

information and applicable fee for each box you checked on line 1 of the

e. Employer's Withholding (WH)...........No fee required

-0-

application in the corresponding lines of the Registration Fee Worksheet.

f. Unemployment Insurance (UI) ..........No fee required

-0-

Also, enter the date the activity began in Hawaii. Please fill in all lines on

the worksheet that apply to your application.

g. Seller's Collection ___/___/___ ........No fee required

-0-

a.

If you checked the box GE, the following fee(s) will apply:

h. Rental Motor Vehicle & Tour Vehicle (RVST)

• If your business began on or after January 1, 1990, a one-time

(enter date activity began on line 30) .......Enter $20.00

$20.00 fee must be paid with this application. Your license will

i. Total Form VP-1 Amount Due. (Add items a thru h)

remain effective until you cancel it; no further fee will be due.

0.00

• If you are a nonprofit organization which has received

Enter this amount on line 33 .........................................

$

exemption from GET and you have paid the $20.00 nonprofit

j. Liquor,

___/___/___......................Check applicable box

registration fee, no fee is due; enter "0" in the space provided.

o Manufacturer o Wholesaler and enter County

• If your business began in Hawaii before January 1, 1990, please

Liquor License No.

,...Enter $2.50

call the Department of Taxation for the appropriate fees.

k. Cigarette and Tobacco, ___/___/___ .check only one

• Do NOT enter an amount on this line if you are applying for a GE

o Dealer

o Wholesaler (see section 245-1, HRS

One-Time Event license number, see Item b.

ENTER THE TOTAL FEE FOR ALL YEARS IN THE SPACE

for definitions).............................................Enter $2.50

PROVIDED.

l. Retail Tobacco Permit, ___/___/___ (not before 12/1/06)

b.

If you checked the box GE One-Time Event, a one-time $20.00 fee

Enter _____ (the number of retail locations) x $20.00

must be paid with this application. Enter $20.00 in the space

m. Liquid Fuel Distributor, ...............check all that apply

provided. If you are a nonprofit organization which has received

o Produce o Refine o Manufacture o Compound

exemption from GET and you have paid the $20.00 nonprofit

registration fee, no fee is due; enter "0" in the space provided.

___/___/___ .........................................No fee required

-0-

• Common one-time events include fundraisers, exhibitions, and

n. Liquid Fuel Retail Dealer ___/___/___

conferences.

...................................................................Enter $5.00

c.

If you checked the box Transient Accommodations (TA), the

following fee(s) will apply:

o. Total Form VP-2 Amount Due. (Add items j thru n)

0.00

• If you first offered a TA for rent on or after January 1, 1990, a

Enter this amount on line 34 .........................................

$

one-time fee of either $5.00 or $15.00 must be paid with this

application. Your registration will remain effective until you

• If you are a trust, an estate, limited liability partnership (LLP),

cancel it; no further fee will be due. Your fee is:

nonprofit organization, or any other entity not listed, please check

—

$5.00 if you have 1-5 TA units.

the box "Other" and write the type of business entity.

—

$15.00 if you have 6 or more TA units.

Line 9. ACCOUNTING PERIOD —

• If your business began in Hawaii before January 1, 1990, please

Calendar Year — If you file your income tax return on a calendar year

call the Department of Taxation for the appropriate fees.

(January 1 through December 31), check this box.

ENTER THE TOTAL FEE FOR ALL YEARS IN THE SPACE

Fiscal Year — If you file your income tax return on other than a calendar

PROVIDED.

year, check this box, and enter the month and day on which your fiscal year

j.

If you checked the box Liquor, enter your county liquor license

ends, using a MM/DD format. For example, a fiscal year ending on March 31

number, the effective date of your license, and check whether you

is written as 03/31.

are a manufacturer or wholesaler of liquor. An annual permit fee

Line 10. ACCOUNTING METHOD —

of $2.50 is due with your application.

Cash — Check this box if you are reporting the income in the period it is

k.

If you checked the box Cigarette and Tobacco, check whether you

received. For example, if you are a monthly filer, you perform a service in

are a dealer or wholesaler of cigarettes or tobacco products. An

March, and you receive payment for that service in May, then as a cash basis

annual license fee of $2.50 is due with your application. If you are a

taxpayer, you report the income when it is received in May.

wholesaler or dealer, who also sells at retail, you have to get a

separate retail tobacco permit.

Accrual — Check this box if you are reporting the income at the time the

service, sale, etc., is performed and you have a right to the income rather than

l.

If you checked the box Retail Tobacco Permit, an annual permit

when payment is received. In the example above, you would report your

fee of $20.00 for each retail location you own, operate, or control is

income when the service was performed which is in March.

due with your application. Note: A vehicle from which cigarettes

or tobacco products are sold is considered a retail location and

Line 11. North American Industry Classification System (NAICS). Enter

requires a retail tobacco permit.

the 6-digit industry classification code that most closely matches your main

m. If you checked the box Liquid Fuel Distributor, check all the boxes

business activity. This would be the principal business or professional

that apply to your business.

activity code that you are required to enter on your federal income tax return.

For more information on these codes, see the federal instructions for

Line 4. Enter your Federal Employer Identification Number (FEIN). If you

reporting your business income. You may also download the 2007 listing

have employees, you must have a FEIN. If you are not required to have a

from the NAICS website at:

FEIN, leave this box blank. If you are a subsidiary member of a controlled

group of corporations, complete lines 18, 19, and 20.

• If you are a sole proprietor or a single-member LLC, please

Then in the space below the NAICS code, describe fully the type of business

complete line 21.

activities you are engaged in, concentrating on your principal activity and the

product/service. Include the percentage based on gross receipts if you are

Line 5. Check the box that describes the type of business entity making the

engaged in more than one type of activity. Examples: General Contractor -

application.

building construction (single-family residential 70%, hotel 10%, commercial

10%, industrial 10%); Manufacturing - men's aloha shirts; Retail - sporting

(continued on the back of Form BB-1, UC-1 copy)

FORM BB-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2