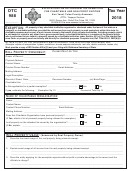

Form 988-S Application for Ad Valorem Tax Exemption for Nonprofit Schools and Colleges

Page 2

You must provide a written explanation as a response to the following questions.

Answers may be attached.

1. Explain exact usage of the real and or personal property being claimed exempt:

_________________________________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

2. Explain exact usage of all income from the real and personal property being claimed exempt:

_________________________________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

Please attach a copy of all documents which support this application

for exemption.

(Example: articles of incorporation, bylaws, resolutions, income-expense statements, deeds,

contracts, leases, catalogs, etc.)

Must provide a copy of IRS Section 501(c)(3) and your filing with Oklahoma Secretary of State.

Please provide the name of person who may be contacted if additional information is needed.

Name: ____________________________________________________ Title: ____________________________

Address: _____________________________________________________________________________________

City: _____________________________________________________ State: ________

Zip: _____________

Phone Number: ( ________ ) ________________________

Affidavit

I, ______________________________________ being duly sworn, upon oath, under penalty of perjury do hereby depose and

say that I am (Title) __________________________________ , of ___________________________________ organization; that

as such I am acquainted with the books, accounts, and affairs of said organization and know the foregoing statements to be true,

correct and complete, and that all information requested herein has been fully and correctly given

(68 O.S. § 2945 provides penalties for false oaths).

Signature: _______________________________________________________________________

Subscribed and sworn to before me this ___________ day of ___________________ , _________ .

My commission expires: ______________________ , _______________ .

____________________________________________________________________ , Notary Public

Notary Seal

Assessor Use Only

School

Application for Exemption:

Approved

Disapproved

District

Assessor/ Deputy: ___________________________________________ Date: ________________

Account Number: ___________________________________________

1

1 2

2