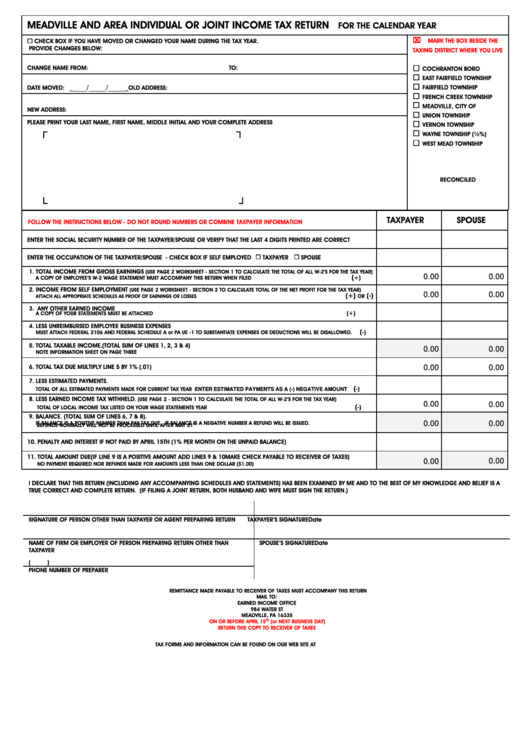

MEADVILLE AND AREA INDIVIDUAL OR JOINT INCOME TAX RETURN

FOR THE CALENDAR YEAR

MARK THE BOX BESIDE THE

CHECK BOX IF YOU HAVE MOVED OR CHANGED YOUR NAME DURING THE TAX YEAR.

PROVIDE CHANGES BELOW:

TAXING DISTRICT WHERE YOU LIVE

CHANGE NAME FROM:

TO:

COCHRANTON BORO

EAST FAIRFIELD TOWNSHIP

____/_____/_____

FAIRFIELD TOWNSHIP

DATE MOVED: _

_OLD ADDRESS:

FRENCH CREEK TOWNSHIP

MEADVILLE, CITY OF

NEW ADDRESS:

UNION TOWNSHIP

PLEASE PRINT YOUR LAST NAME, FIRST NAME, MIDDLE INITIAL AND YOUR COMPLETE ADDRESS

VERNON TOWNSHIP

┌

┐

WAYNE TOWNSHIP (½%)

WEST MEAD TOWNSHIP

RECONCILED

└

┘

TAXPAYER

SPOUSE

FOLLOW THE INSTRUCTIONS BELOW - DO NOT ROUND NUMBERS OR COMBINE TAXPAYER INFORMATION

ENTER THE SOCIAL SECURITY NUMBER OF THE TAXPAYER/SPOUSE OR VERIFY THAT THE LAST 4 DIGITS PRINTED ARE CORRECT

ENTER THE OCCUPATION OF THE TAXPAYER/SPOUSE - CHECK BOX IF SELF EMPLOYED TAXPAYER SPOUSE

1. TOTAL INCOME FROM GROSS EARNINGS

(USE PAGE 2 WORKSHEET - SECTION 1 TO CALCULATE THE TOTAL OF ALL W-2’S FOR THE TAX YEAR)

0.00

0.00

(

+)

A COPY OF EMPLOYEE’S W-2 WAGE STATEMENT MUST ACCOMPANY THIS RETURN WHEN FILED

2. INCOME FROM SELF EMPLOYMENT

(USE PAGE 2 WORKSHEET - SECTION 2 TO CALCULATE TOTAL OF THE NET PROFIT FOR THE TAX YEAR)

0.00

0.00

( +)

(-)

ATTACH ALL APPROPRIATE SCHEDULES AS PROOF OF EARNINGS OR LOSSES

OR

3. ANY OTHER EARNED INCOME

(+)

A COPY OF YOUR STATEMENTS MUST BE ATTACHED

4. LESS UNREIMBURSED EMPLOYEE BUSINESS EXPENSES

(

-)

MUST ATTACH FEDERAL 2106 AND FEDERAL SCHEDULE A or PA UE -1 TO SUBSTANTIATE EXPENSES OR DEDUCTIONS WILL BE DISALLOWED.

5. TOTAL TAXABLE INCOME.(TOTAL SUM OF LINES 1, 2, 3 & 4)

0.00

0.00

NOTE INFORMATION SHEET ON PAGE THREE

6. TOTAL TAX DUE MULTIPLY LINE 5 BY 1% (.01)

0.00

0.00

7. LESS ESTIMATED PAYMENTS

.

(

-)

TOTAL OF ALL ESTIMATED PAYMENTS MADE FOR CURRENT TAX YEAR

ENTER ESTIMATED PAYMENTS AS A (-) NEGATIVE AMOUNT

8. LESS EARNED INCOME TAX WITHHELD

. (USE PAGE 2 - SECTION 1 TO CALCULATE THE TOTAL OF ALL W-2’S FOR THE TAX YEAR)

0.00

0.00

(

-)

TOTAL OF LOCAL INCOME TAX LISTED ON YOUR WAGE STATEMENTS YEAR

9. BALANCE. (TOTAL SUM OF LINES 6, 7 & 8).

IF BALANCE IS A POSITIVE NUMBER THAN PAY TAX DUE. IF BALANCE IS A NEGATIVE NUMBER A REFUND WILL BE ISSUED.

0.00

0.00

ST

REFUNDS NORMALLY WILL NOT BE PROCESSED UNTIL AFTER MAY 31

10. PENALTY AND INTEREST IF NOT PAID BY APRIL 15TH (1% PER MONTH ON THE UNPAID BALANCE)

11. TOTAL AMOUNT DUE (IF LINE 9 IS A POSITIVE AMOUNT ADD LINES 9 & 10 MAKE CHECK PAYABLE TO RECEIVER OF TAXES)

0.00

0.00

NO PAYMENT REQUIRED NOR REFUNDS MADE FOR AMOUNTS LESS THAN ONE DOLLAR ($1.00)

I DECLARE THAT THIS RETURN (INCLUDING ANY ACCOMPANYING SCHEDULES AND STATEMENTS) HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A

TRUE CORRECT AND COMPLETE RETURN. (IF FILING A JOINT RETURN, BOTH HUSBAND AND WIFE MUST SIGN THE RETURN.)

SIGNATURE OF PERSON OTHER THAN TAXPAYER OR AGENT PREPARING RETURN

TAXPAYER’S SIGNATURE

Date

NAME OF FIRM OR EMPLOYER OF PERSON PREPARING RETURN OTHER THAN

SPOUSE’S SIGNATURE

Date

TAXPAYER

(

)

PHONE NUMBER OF PREPARER

REMITTANCE MADE PAYABLE TO RECEIVER OF TAXES MUST ACCOMPANY THIS RETURN

MAIL TO:

EARNED INCOME OFFICE

984 WATER ST

MEADVILLE, PA 16335

ON OR BEFORE APRIL 15

TH

(or NEXT BUSINESS DAY)

RETURN THIS COPY TO RECEIVER OF TAXES

TAX FORMS AND INFORMATION CAN BE FOUND ON OUR WEB SITE AT

1

1 2

2 3

3