th

th

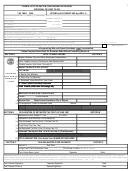

TAX R ETURNS M UST B E P OSTMARKED NO LATER T HAN APRIL 1 5

. R ETURNS P OSTMARKED AFTER APRIL 1 5

WILL B E ASSESSED W ITH

PENALTY AND INTEREST

IF YOU DO NO T RECEIVE A LOCAL E ARNED INCOME T AX R ETURN FORM IN THE M AIL FROM THIS O FFICE IT IS NO T A V ALID E XCUSE FOR

NOT FILING. ADDITIONAL RETURN FORMS MAY BE OBTAINED BY CONTACTING THIS OFFICE AT THE C ITY BUILDING, 984 WATER STREET,

MEADVILLE, PA 16335 OR ON OUR WEB SITE AT

A RETURN MUST BE FILED EVEN IF:

1.

You are or were a college student.

2.

There are no earnings and/or no tax is due.

3.

The tax was withheld by your employer

TAX RATE: The earned income tax is one percent (1 %) of the taxable income.

st

st

TAXABLE INCOME: Net Profits and Earned Income for the period of January 1

through December 31

. Taxable Income Includes:

1.

Gross earnings, salaries, wages, bonuses, commissions, fees, incentive payments, tips, contributions made to an annuity or deferred income plan and other

compensation or remuneration such as vacation pay, severance pay or taxes assumed by the employer to the employee for services rendered in cash, property

or services.

2

Military Reserve pay and National Guard pay (except active duty).

3.

Stipends and Fellowships

4.

Net Profits from Business, Farming and/or Partnerships.

5.

Profit Sharing plans and pension plans that are also taxable by the State.

6.

Fees and Honorarium (Fees paid to Corporation Directors/Officers or Estate Executors/Administrators)

NON- TAXABLE INCOME: Supplemental Unemployment Benefits (SUB PAY); Unemployment Benefits; Public Assistance; Interest; Dividends; Scholarships;

Active Duty Military Service Pay; Social Security Benefits; Lottery Winnings; Strike Pay; Cost of Group Term Life Insurance: Disability and 3rd Party Sick Pay;

Annuities; Pensions; IRA Pension Payments received upon retirement; Proceeds from Insurance Policies; Death Benefit payments to an employee's beneficiary or

estate; cash or property received by a will. Parsonage/Housing allowance payments received by the taxpayer.

PROOF OF EARNINGS: Must accompany each return. Include all W-2's, applicable 1099's and all applicable schedules. This Information should indicate the

municipality to which any withheld tax was paid or the area in which you were employed.

SELF-EMPLOYED/BUSINESS PROFIT AND LOSSES:

1.

Self-Employed Individuals are required to file a tax return even if you sustained a net loss. Enclose a copy of the Schedule or Schedules showing the loss.

NET LOSS OF ONE SPOUSE NETTED AGAINST THE EARNINGS OF THE OTHER IS NOT PERMITTED.

2.

A

taxpayer IS PERMITTED to offset a business loss against wages and other compensation (W-2 earnings -- line 1). A taxpayer MAY

offset a loss from one business entity against a net profit from another business entity and will report the net profit on line 2.

3.

If you are Self-Employed during the tax year, indicate the type of business or profession and list the net profit or loss on the Individual Tax Return. Submit

all appropriate schedules as proof of earnings. (Federal or State forms are acceptable).

Examples are:

Schedule C - Net Profits from Business

Schedule K - 1 Net Profit from Partnership

Schedule F - Net Profits from Farming

UNREIMBURSED EMPLOYEE BUSINESS EXPENSES: "Ordinary, Necessary, Reasonable and Actual" Business Expenses not reimbursed by your employer will be

permitted as an allowable deduction, provided each expense is required by the employer in order for the taxpayer to keep his or her present job.

1.

An exact, duplicate copy of the Federal Form 2106 is required, as provided to the Internal Revenue Service. THE BUSINESS EXPENSE FORMS MUST

BE COMPLETED IN THEIR ENTIRETY, IF THE EXPENSE DEDUCTION FORMS ARE OMITTED, OR ARE NOT FULLY COMPLETE, THE

EXPENSE DEDUCTIONS WILL BE DISALLOWED.

2.

Each expense is to be explained in detail on the forms, as per each form's instructions. All federal schedules must be included to substantiate actual expenses

taken. Records are to be available for verification and are subject to review at the Bureau office during normal office hours.

3.

Estimates are not acceptable.

4.

Allowable Expenses: Union Dues, Clothing Allowance, Small Tools & Supplies, Professional License Fees & Bond Insurance Premiums.

REMITTANCE: Checks should be made payable to Receiver of Taxes. Your cancelled check or money order is your receipt unless a stamped envelope is enclosed. If

your Balance Due is ninety-nine (.99) cents or less, the amount due need not be remitted. Prepayments are acceptable for self-employed individuals and for employees

who do not have the earned income tax withheld from their earnings. Forms for estimated prepayments will be provided upon request. BAD CHECKS WILL

RECEIVE A PENALTY CHARGE 0F $20.00.

REFUNDS: Overpayments of $1.00 or more will be refunded. Refunds totaling $10.00 or more must be reported by this Bureau to the Internal Revenue Service.

st

Therefore, you must provide us with your correct Social Security Number on your tax form. Refunds normally will not be processed until after May 31

. All W2's and

schedules must be attached before a refund will be considered.

DUE DATE: Any tax due is payable upon filing the tax return and must be filed and paid in full by April 15. THERE IS NO EXTENSION FOR PAYMENT OF TAX.

PENALTY AND INTEREST: Payable at the rate of 1% per month or any portion of a month that the earned Income tax remains ul1paid after the filing date of April

15th.

EXTENSION REQUESTS: We require a copy of your Federal Tax Extension Form (4868). It must be received at this Bureau or postmarked by Penalty and Interest

th

will be due on the unpaid balance if your tax payment is received after April 15

. Penalty and interest will be due on the unpaid balance if your tax payment is received

after April 15

th

.

1

1 2

2 3

3