Form W-1 - Employer'S Return Of Tax Withheld

ADVERTISEMENT

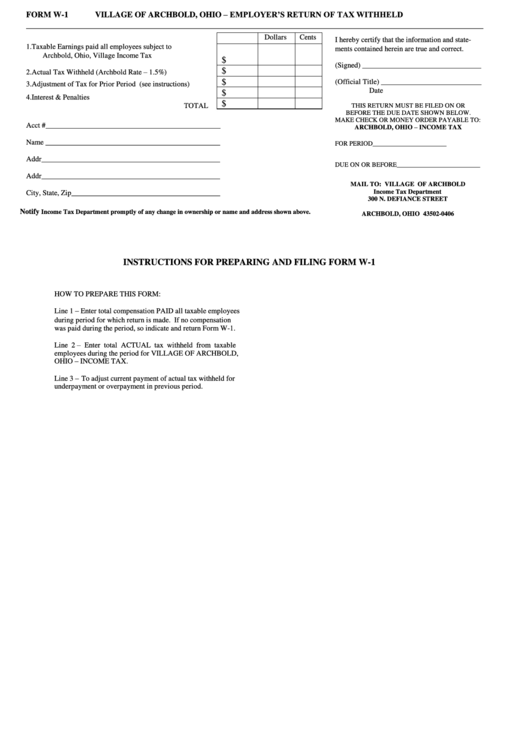

VILLAGE OF ARCHBOLD, OHIO – EMPLOYER’S RETURN OF TAX WITHHELD

FORM W-1

___________________________________________________________________________________________________

Dollars

Cents

I hereby certify that the information and state-

1.

Taxable Earnings paid all employees subject to

ments contained herein are true and correct.

Archbold, Ohio, Village Income Tax

$

(Signed) ________________________________

$

Actual Tax Withheld (Archbold Rate – 1.5%)

2.

$

(Official Title) ___________________________

3.

Adjustment of Tax for Prior Period (see instructions)

Date

$

4.

Interest & Penalties

$

TOTAL

THIS RETURN MUST BE FILED ON OR

BEFORE THE DUE DATE SHOWN BELOW.

MAKE CHECK OR MONEY ORDER PAYABLE TO:

Acct #_______________________________________________

ARCHBOLD, OHIO – INCOME TAX

Name _______________________________________________

FOR PERIOD_______________________

Addr________________________________________________

DUE ON OR BEFORE__________________________

Addr________________________________________________

MAIL TO: VILLAGE OF ARCHBOLD

Income Tax Department

City, State, Zip________________________________________

300 N. DEFIANCE STREET

P.O. BOX 406

Notify

Income Tax Department promptly of any change in ownership or name and address shown above.

ARCHBOLD, OHIO 43502-0406

INSTRUCTIONS FOR PREPARING AND FILING FORM W-1

HOW TO PREPARE THIS FORM:

Line 1 – Enter total compensation PAID all taxable employees

during period for which return is made. If no compensation

was paid during the period, so indicate and return Form W-1.

Line 2 – Enter total ACTUAL tax withheld from taxable

employees during the period for VILLAGE OF ARCHBOLD,

OHIO – INCOME TAX.

Line 3 – To adjust current payment of actual tax withheld for

underpayment or overpayment in previous period.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1