Form W-1 - Employer'S Return Of Tax Withheld

ADVERTISEMENT

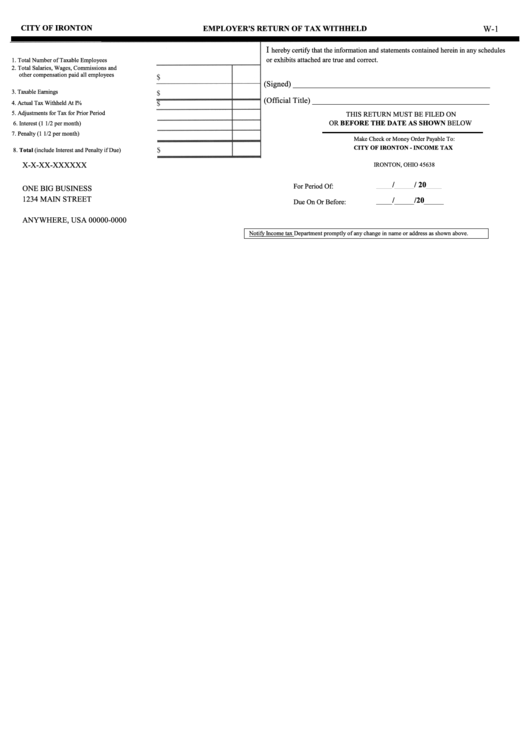

CITY OF IRONTON

EMPLOYER'S RETURN OF TAX WITHHELD

W-1

I

hereby certify that the information and statements contained herein in any schedules

or exhibits attached are true and correct.

1. Total Number of Taxable Employees

2. Total Salaries, Wages, Commissions and

other compensation paid all employees

(Signed) __________________________________________________

3. Taxable Earnings

(Official Title) _____________________________________________

4. Actual Tax Withheld At I%

5. Adjustments for Tax for Prior Period

THIS RETURN MUST BE FILED ON

OR BEFORE THE DATE AS SHOWN BELOW

6. Interest (1 1/2 per month)

7. Penalty (1 1/2 per month)

Make Check or Money Order Payable To:

CITY OF IRONTON - INCOME TAX

8. Total (include Interest and Penalty if Due)

P.O. Box 704

X-X-XX-XXXXXX

IRONTON, OHIO 45638

____/_____/ 20____

For Period Of:

ONE BIG BUSINESS

1234 MAIN STREET

____/_____/20_____

Due On Or Before:

P.O. BOX 12345

ANYWHERE, USA 00000-0000

Notify Income tax Department promptly of any change in name or address as shown above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1