Form Mw-1 - Employer'S Return Of Tax Withheld Page 2

ADVERTISEMENT

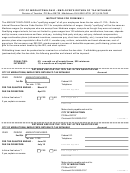

Account

CITY OF MIDDLETOWN, EMPLOYER'S RETURN FO TAX WITHHELD

RETURNS ARE DUE THE 15TH DAY AFTER QUARTER END

YEAR

PERIOD

AMOUNT ENCLOSED

3rd Qtr

$

Federal I.D.

Tax rate: 1.75%

Telephone

FOR THE QUARTER ENDING :

September 30

Authorized Signature

DUE ON OR BEFORE:

October 15

Print or Type Name

Is this a final return ?

YES

NO

If yes, explain on reverse

Official Title

Make check payable and mail to:

CITY OF MIDDLETOWN

PO Box 630157

Cincinnati OH 45263-0157

Form MW-1

RETURNS ARE DUE THE 15TH DAY AFTER QUARTER END

Account

CITY OF MIDDLETOWN, EMPLOYER'S RETURN FO TAX WITHHELD

YEAR

PERIOD

AMOUNT ENCLOSED

4th Qtr

$

Federal I.D.

Tax rate: 1.75%

Telephone

FOR THE QUARTER ENDING :

December 31

Authorized Signature

DUE ON OR BEFORE:

January 15

Print or Type Name

Is this a final return ?

YES

NO

If yes, explain on reverse

Official Title

Make check payable and mail to:

CITY OF MIDDLETOWN

PO Box 630157

Cincinnati OH 45263-0157

Form MW-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3