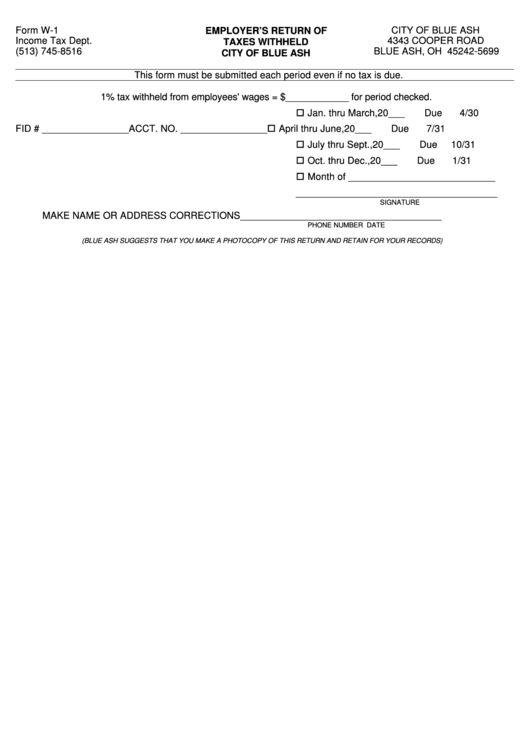

Form W-1 - Employer'S Return Of Taxes Withheld

ADVERTISEMENT

Form W-1

CITY OF BLUE ASH

EMPLOYER’S RETURN OF

Income Tax Dept.

4343 COOPER ROAD

TAXES WITHHELD

(513) 745-8516

BLUE ASH, OH 45242-5699

CITY OF BLUE ASH

This form must be submitted each period even if no tax is due.

1% tax withheld from employees' wages = $____________ for period checked.

o Jan. thru March,

20___

Due

4/30

o April thru June,

FID # ________________

ACCT. NO. ________________

20___

Due

7/31

o July thru Sept.,

20___

Due

10/31

o Oct. thru Dec.,

20___

Due

1/31

o Month of ___________________________

_____________________________________

SIGNATURE

MAKE NAME OR ADDRESS CORRECTIONS

_____________________________________

PHONE NUMBER

DATE

(BLUE ASH SUGGESTS THAT YOU MAKE A PHOTOCOPY OF THIS RETURN AND RETAIN FOR YOUR RECORDS)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1