Form Rev706 - Nstructions For Completing The Business/account Cancellation

ADVERTISEMENT

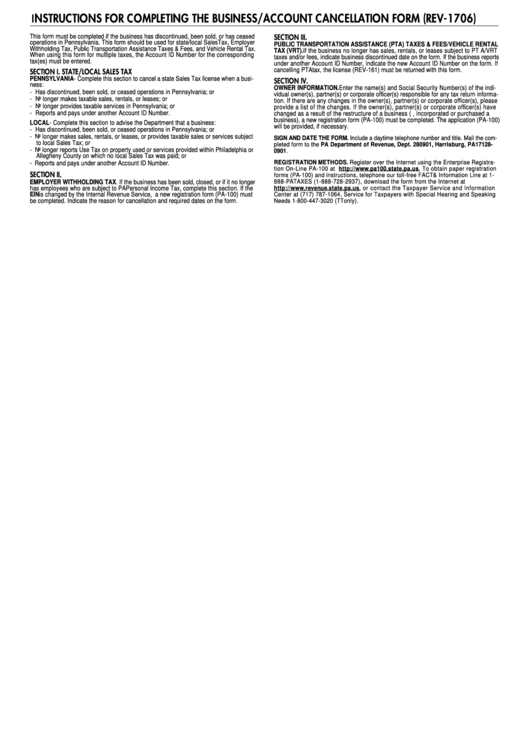

NSTRUCTIONS FOR COMPLETING THE BUSINESS/ACCOUNT CANCELLATION FORM (REV - 1 7 0 6 )

I

SECTION III.

This form must be completed if the business has discontinued, been sold, or has ceased

operations in Pennsylvania. This form should be used for state/local SalesTax, Employer

PUBLIC TRANSPORTATION A S S I S TANCE (PTA) TAXES & FEES/VEHICLE RENTA L

Withholding Tax, Public Transportation Assistance Taxes & Fees, and Vehicle Rental Ta x .

TAX (VRT). If the business no longer has sales, rentals, or leases subject to PT A / V RT

When using this form for multiple taxes, the Account ID Number for the corresponding

taxes and/or fees, indicate business discontinued date on the form. If the business reports

tax(es) must be entered.

under another Account ID Number, indicate the new Account ID Number on the form. If

cancelling PTAtax, the license (REV-161) must be returned with this form.

SECTION I. STATE/LOCAL SALES T A X

P E N N S Y LVA N I A - Complete this section to cancel a state Sales Tax license when a busi-

SECTION IV.

n e s s :

OWNER INFORMAT I O N . Enter the name(s) and Social Security Number(s) of the indi-

- Has discontinued, been sold, or ceased operations in Pennsylvania; or

vidual owner(s), partner(s) or corporate officer(s) responsible for any tax return informa-

- No longer makes taxable sales, rentals, or leases; or

tion. If there are any changes in the owner(s), partner(s) or corporate officer(s), please

- No longer provides taxable services in Pennsylvania; or

provide a list of the changes. If the owner(s), partner(s) or corporate officer(s) have

- Reports and pays under another Account ID Number.

changed as a result of the restructure of a business (e.g., incorporated or purchased a

business), a new registration form (PA-100) must be completed. The application (PA - 1 0 0 )

L O C A L - Complete this section to advise the Department that a business:

will be provided, if necessary.

- Has discontinued, been sold, or ceased operations in Pennsylvania; or

- No longer makes sales, rentals, or leases, or provides taxable sales or services subject

SIGN AND DATE THE FORM. Include a daytime telephone number and title. Mail the com-

to local Sales Tax; or

pleted form to the PA Department of Revenue, Dept. 280901, Harrisburg, PA 1 7 1 2 8 -

- No longer reports Use Tax on property used or services provided within Philadelphia or

0 9 0 1.

Allegheny County on which no local Sales Tax was paid; or

R E G I S T R ATION M E T H O D S. Register over the Internet using the Enterprise Registra-

- Reports and pays under another Account ID Number.

tion On-Line PA-100 at h t t p : / / w w w. p a 1 0 0 . s t a t e. p a . u s. To obtain paper registration

SECTION II.

forms (PA-100) and instructions, telephone our toll-free F A C T & Information Line at 1-

EMPLOYER WITHHOLDING TA X. If the business has been sold, closed, or if it no longer

8 8 8 - PA TAXES (1-888-728-2937), download the form from the Internet at

has employees who are subject to PA Personal Income Tax, complete this section. If the

h t t p : / / w w w. r ev e nu e. s t a t e. p a . u s, or contact the Taxpayer Service and Information

E I N is changed by the Internal Revenue Service, a new registration form (PA-100) must

Center at (717) 787-1064, Service for Taxpayers with Special Hearing and Speaking

be completed. Indicate the reason for cancellation and required dates on the form.

Needs 1-800-447-3020 (TT o n l y ) .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1