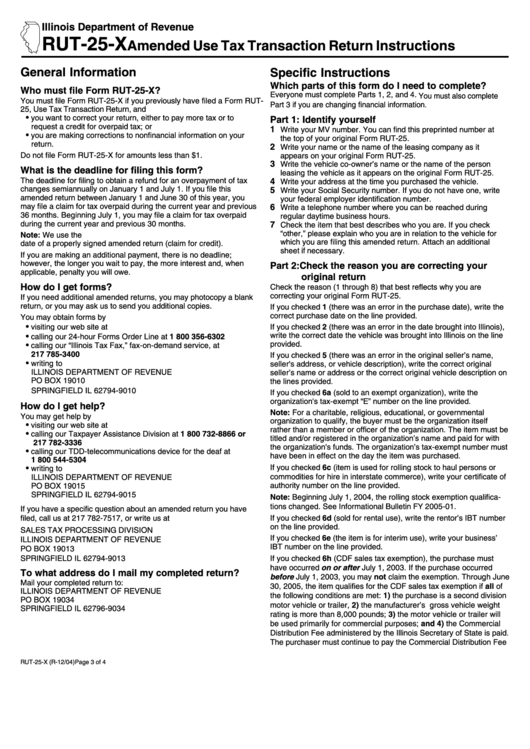

Rut-25-X Amended Use Tax Transaction Return Instructions

ADVERTISEMENT

Illinois Department of Revenue

RUT-25-X

Amended Use Tax Transaction Return Instructions

General Information

Specific Instructions

Which parts of this form do I need to complete?

Who must file Form RUT-25-X?

Everyone must complete Parts 1, 2, and 4. You must also complete

You must file Form RUT-25-X if you previously have filed a Form RUT-

Part 3 if you are changing financial information.

25, Use Tax Transaction Return, and

•

you want to correct your return, either to pay more tax or to

Part 1: Identify yourself

request a credit for overpaid tax; or

1

Write your MV number. You can find this preprinted number at

•

you are making corrections to nonfinancial information on your

the top of your original Form RUT-25.

return.

2

Write your name or the name of the leasing company as it

Do not file Form RUT-25-X for amounts less than $1.

appears on your original Form RUT-25.

3

Write the vehicle co-owner’s name or the name of the person

What is the deadline for filing this form?

leasing the vehicle as it appears on the original Form RUT-25.

The deadline for filing to obtain a refund for an overpayment of tax

4

Write your address at the time you purchased the vehicle.

changes semiannually on January 1 and July 1. If you file this

5

Write your Social Security number. If you do not have one, write

amended return between January 1 and June 30 of this year, you

your federal employer identification number.

may file a claim for tax overpaid during the current year and previous

6

Write a telephone number where you can be reached during

36 months. Beginning July 1, you may file a claim for tax overpaid

regular daytime business hours.

during the current year and previous 30 months.

7

Check the item that best describes who you are. If you check

“other,” please explain who you are in relation to the vehicle for

Note: We use the U.S. Postal Service postmark date as the filing

which you are filing this amended return. Attach an additional

date of a properly signed amended return (claim for credit).

sheet if necessary.

If you are making an additional payment, there is no deadline;

however, the longer you wait to pay, the more interest and, when

Part 2: Check the reason you are correcting your

applicable, penalty you will owe.

original return

How do I get forms?

Check the reason (1 through 8) that best reflects why you are

correcting your original Form RUT-25.

If you need additional amended returns, you may photocopy a blank

return, or you may ask us to send you additional copies.

If you checked 1 (there was an error in the purchase date), write the

correct purchase date on the line provided.

You may obtain forms by

•

If you checked 2 (there was an error in the date brought into Illinois),

visiting our web site at

write the correct date the vehicle was brought into Illinois on the line

•

calling our 24-hour Forms Order Line at 1 800 356-6302

provided.

•

calling our “Illinois Tax Fax,” fax-on-demand service, at

217 785-3400

If you checked 5 (there was an error in the original seller’s name,

•

writing to

seller's address, or vehicle description), write the correct original

ILLINOIS DEPARTMENT OF REVENUE

seller’s name or address or the correct original vehicle description on

PO BOX 19010

the lines provided.

SPRINGFIELD IL 62794-9010

If you checked 6a (sold to an exempt organization), write the

organization's tax-exempt “E” number on the line provided.

How do I get help?

Note: For a charitable, religious, educational, or governmental

You may get help by

organization to qualify, the buyer must be the organization itself

•

visiting our web site at

rather than a member or officer of the organization. The item must be

•

calling our Taxpayer Assistance Division at 1 800 732-8866 or

titled and/or registered in the organization’s name and paid for with

217 782-3336

the organization's funds. The organization’s tax-exempt number must

•

calling our TDD-telecommunications device for the deaf at

have been in effect on the day the item was purchased.

1 800 544-5304

If you checked 6c (item is used for rolling stock to haul persons or

•

writing to

commodities for hire in interstate commerce), write your certificate of

ILLINOIS DEPARTMENT OF REVENUE

authority number on the line provided.

PO BOX 19015

SPRINGFIELD IL 62794-9015

Note: Beginning July 1, 2004, the rolling stock exemption qualifica-

tions changed. See Informational Bulletin FY 2005-01.

If you have a specific question about an amended return you have

filed, call us at 217 782-7517, or write us at

If you checked 6d (sold for rental use), write the rentor’s IBT number

on the line provided.

SALES TAX PROCESSING DIVISION

If you checked 6e (the item is for interim use), write your business’

ILLINOIS DEPARTMENT OF REVENUE

IBT number on the line provided.

PO BOX 19013

SPRINGFIELD IL 62794-9013

If you checked 6h (CDF sales tax exemption), the purchase must

have occurred on or after July 1, 2003. If the purchase occurred

To what address do I mail my completed return?

before July 1, 2003, you may not claim the exemption. Through June

Mail your completed return to:

30, 2005, the item qualifies for the CDF sales tax exemption if all of

ILLINOIS DEPARTMENT OF REVENUE

the following conditions are met: 1) the purchase is a second division

PO BOX 19034

motor vehicle or trailer, 2) the manufacturer’s gross vehicle weight

SPRINGFIELD IL 62796-9034

rating is more than 8,000 pounds; 3) the motor vehicle or trailer will

be used primarily for commercial purposes; and 4) the Commercial

Distribution Fee administered by the Illinois Secretary of State is paid.

The purchaser must continue to pay the Commercial Distribution Fee

RUT-25-X (R-12/04)

Page 3 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2