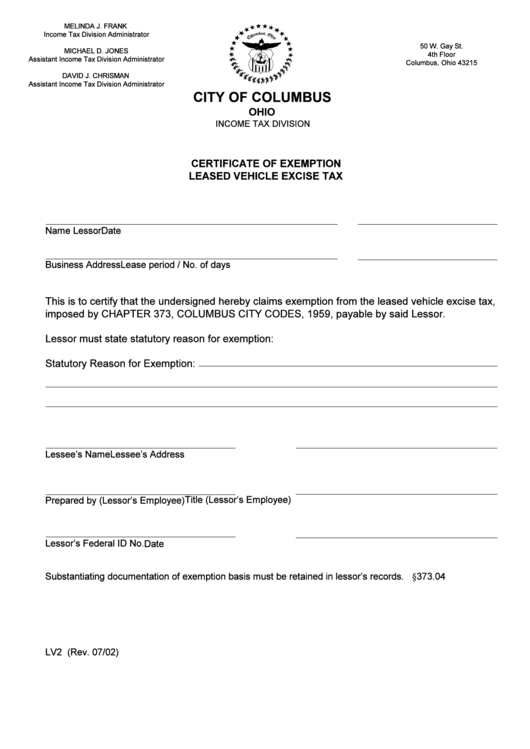

Form Lv2 - Certificate Of Exemption Leased Vehicle Excise Tax - City Of Columbus, Ohio

ADVERTISEMENT

MELINDA J. FRANK

Income Tax Division Administrator

50 W. Gay St.

MICHAEL D. JONES

4th Floor

Assistant Income Tax Division Administrator

Columbus, Ohio 43215

DAVID J. CHRISMAN

Assistant Income Tax Division Administrator

CITY OF COLUMBUS

OHIO

INCOME TAX DIVISION

CERTIFICATE OF EXEMPTION

LEASED VEHICLE EXCISE TAX

Name Lessor

Date

Business Address

Lease period / No. of days

This is to certify that the undersigned hereby claims exemption from the leased vehicle excise tax,

imposed by CHAPTER 373, COLUMBUS CITY CODES, 1959, payable by said Lessor.

Lessor must state statutory reason for exemption:

Statutory Reason for Exemption:

Lessee’s Name

Lessee’s Address

Title (Lessor’s Employee)

Prepared by (Lessor’s Employee)

Lessor’s Federal ID No.

Date

Substantiating documentation of exemption basis must be retained in lessor’s records. C.C.C. §373.04

LV2 (Rev. 07/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1