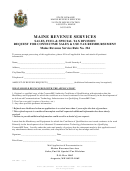

Maine Revenue Services Sales, Fuel & Special Tax Division Instructional Bulletin No. 46 Sheet Page 3

ADVERTISEMENT

2.

REPAIR SERVICES

"Fabrication services" does not include the repair, refurbishing or reconditioning of

tangible personal property to refit it for the use for which it was originally produced as long as

such services are separately stated from the charge for repair parts or other tangible personal

property sold in connection with the repair service.

The following are examples of the types of services that constitute repair services rather

than fabrication services and are not subject to the service provider tax:

• Reupholstering furniture

• Refinishing furniture

• Rust removal

• Sanding and/or repainting tangible personal property

• Sharpening saw blades

3.

APPLICATION OR INSTALLATION SERVICES

"Fabrication services" does not include a charge for attaching, affixing, installing or

applying a completed item of tangible personal property to other tangible personal property or to

real property as long as such services are separately stated from the charge for tangible personal

property sold in connection with the service.

The following are examples of the types of services that constitute application or

installation services rather than fabrication services and are not subject to the service provider

tax:

• Framing services –the labor charge for attaching a customer’s piece of art to a

frame

• Installing kitchen cabinets in a residence –the labor charge by a carpenter to

install kitchen cabinets that were provided by the customer

• The labor charge associated with painting a building

4.

EXEMPT SALES OF FABRICATION SERVICES

The service provider tax does not apply to sales of fabrication services in the following

situations:

a.

Fabrication of exempt commodities. The tax does not apply to charges for

fabrication of tangible personal property where a sale to the consumer of the tangible

personal property being fabricated is exempt or otherwise not subject to tax. Examples

of exempt fabrication services are fabrication of machinery or equipment for use directly

and primarily in production of tangible personal property for later sale or lease, and

production or processing of food products for home consumption.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8