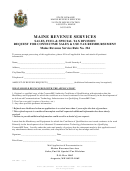

Maine Revenue Services Sales, Fuel & Special Tax Division Instructional Bulletin No. 46 Sheet Page 8

ADVERTISEMENT

C. Rental of video media and video equipment;

D. Rental of furniture, audio media and audio equipment pursuant to a rental-

purchase agreement as defined in Title 9-A, section 11-105;

E. Telecommunications services;

F. The installation, maintenance or repair of telecommunications equipment; and

G. Private nonmedical institution services.

Sales Tax

36 MRSA §1752, sub-§ 7-B. Machinery and equipment. "Machinery and equipment" means

machinery, equipment and parts and attachments for machinery and equipment, but excludes

foundations for machinery and equipment and special purpose buildings used to house or support

machinery and equipment.

36 MRSA §1752, sub- § 17. Tangible personal property. "Tangible personal property" means

personal property which may be seen, weighed, measured, felt, touched or in any other manner

perceived by the senses, but does not include rights and credits, insurance policies, bills of ex-

change, stocks and bonds and similar evidences of indebtedness or ownership. "Tangible per-

sonal property" includes electricity. “Tangible personal property” includes any computer soft-

ware that is not a customer computer software program.

36 MRSA §1760, sub-§31. Machinery and equipment. Sales of machinery and equipment:

A. For use by the purchaser directly and primarily in the production of tangible personal

property intended to be sold or leased ultimately for final use or consumption or in the

production of tangible personal property pursuant to a contract with the United States

Government or any agency thereof, or, in the case of sales occurring after June 30, 2005,

in the generation of radio and television broadcast signals by broadcast stations regulated

under 47 Code of Federal Regulations, Part 73. This exemption applies even if the pur-

chaser sells the machinery or equipment and leases it back in a sale and leaseback trans-

action. This exemption also applies whether the purchaser agrees before or after the pur-

chase of the machinery or equipment to enter into the sale and leaseback transaction and

whether the purchaser's use of the machinery or equipment in production commences be-

fore or after the sale and leaseback transaction occurs; and

36 MRSA §1760, sub-§ 74. Property used in production. Sales of tangible personal property,

other than fuel or electricity, that becomes an ingredient or component part of, or that is con-

sumed or destroyed or loses its identity directly and primarily in either the production of tangible

personal property for later sale or lease, for use in this State, or the production of tangible per-

sonal property pursuant to a contract with the United States Government or any agency of the

United State Government. Tangible personal property is "consumed or destroyed" or "loses its

identity" in that production if it has a normal physical life expectancy of less than one year as a

usable item in the use to which it is applied.

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8