Maine Revenue Services Sales, Fuel & Special Tax Division Instructional Bulletin No. 46 Sheet Page 6

ADVERTISEMENT

Purchases of items that will become an ingredient or component part of fabricated

property to be incorporated into real estate by the fabricator are subject to sales and

use tax.

c.

Consumed or destroyed.

The Sales and Use Tax Law also provides an

exemption for tangible personal property that is consumed or destroyed or loses its

identity directly and primarily in the production of tangible personal property for later

sale or lease, other than lease for use in this State. Fuel and electricity are specifically

excepted from this exemption. In order to qualify for this exemption, an item that is

"consumed or destroyed" must have an actual physical life expectancy of less than one

year in the use to which it is applied without regard to obsolescence.

In order to be exempt under this provision, items must be consumed or destroyed directly

and primarily in production meeting the qualifications set forth in paragraph a,

"Machinery and equipment", above.

6.

ADDITIONAL INFORMATION.

The information in this bulletin addresses some of the more common questions regarding

the Sales, Use, and Service Provider Tax Law faced by your business. It is not intended to be all

inclusive. Requests for information on specific situations should be in writing, should contain

full information as to the transaction in question and should be directed to:

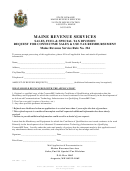

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

P.O. BOX 1065

AUGUSTA, ME 04332-1065

TEL: (207) 624-9693 FAX: (207) 287-6628

TTY: NexTalk 1-888-577-6690

The Department of Administrative and Financial Services does not discriminate on the basis of

disability in admission to, access to, or operation of its programs, services or activities.

Issued: July 16, 1986

Last Amended: September 12, 2006

(Published under Appropriation 010-18F-0002-07)

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8