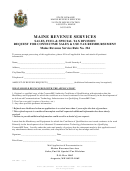

Maine Revenue Services Sales, Fuel & Special Tax Division Instructional Bulletin No. 46 Sheet Page 4

ADVERTISEMENT

b.

Fabrication for exempt organizations. The tax does not apply to sales of

fabrication services to the federal government, this State or political subdivisions of this

State (such as counties, cities, or towns) or any agency of any of the above governments;

or to any other entity (such as a school, church or hospital) that has been issued an

exemption certificate by Maine Revenue Services.

c.

Fabrication of tangible personal property for resale. The tax does not apply

to fabrication of tangible personal property for a purchaser who will resell it in the form

of tangible personal property, unless the subsequent resale of the property will be at

casual sale. Persons making sales of fabrication services for resale should require the

purchaser to furnish a resale certificate.

d.

Additions to real property.

“Fabrication services" does not include the

transformation of tangible personal property by a person that incorporates the

transformed property into real property. Fabrication of tangible personal property that is

to be incorporated into real property by the fabricator will be treated as follows:

i.

Passage of title prior to incorporation into real property. Where the

contractor passes title to the tangible personal property before incorporating it

into the real property, fabrication services are subject to the tax. For example, a

cabinetmaker contracts to fabricate and install kitchen cabinets. If the contract

provides that the purchaser takes title to the cabinets before installation, the full

amount of the sale, including fabrication services, is subject to the tax. A sheet

metal shop contracts to fabricate and install ductwork into real property. If the

contract provides that the purchaser takes title to the ductwork before installation,

the full amount of the sale is subject to the tax. In both cases, installation service

is not subject to the tax if it is separately stated on the invoice to the customer.

ii.

Passage of title after incorporation into real property. Where the

contractor passes title to the tangible personal property after incorporating it into

the real property, fabrication services are not subject to the tax. (The State Tax

Assessor will assume that title to the tangible personal property does not pass

until after it has been installed, unless the contract specifically states otherwise.)

For example, a cabinetmaker contracts to build and install kitchen cabinets. If

there is no title provision in the contract, or if the contract states that title will pass

after installation, the cabinetmaker will be liable for tax on the tangible personal

property. The cabinet maker will also be liable for the tax on any fabrication

services that it may purchase. The same holds true for a sheet metal shop that

contracts to fabricate ductwork and install it into real property.

Charges for fabrication of tangible personal property that will be incorporated into real

property are subject to tax unless the property is incorporated by the fabricator.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8