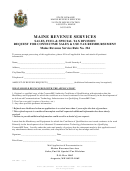

Maine Revenue Services Sales, Fuel & Special Tax Division Instructional Bulletin No. 46 Sheet Page 7

ADVERTISEMENT

ATTACHMENT #1

Excerpts taken from 36 M.R.S.A.

Service Provider Tax

36 MRSA §2551, sub-§ 3. Fabrication services. "Fabrication services" means the production

of tangible personal property for a consideration for a person who furnishes, either directly or in-

directly, the materials used in that production. "Fabrication services" does not include the pro-

duction of tangible personal property if a sale to the consumer of the tangible personal property

so produced would be exempt or otherwise not subject to tax under Part 3.

36 MRSA §2551, sub- § 12. Production. "Production" means an operation or integrated series

of operations engaged in as a business or segment of a business that transforms or converts per-

sonal property by physical, chemical or other means into a form, composition or character differ-

ent from that in which it originally existed. "Production" includes manufacturing, processing,

assembling and fabricating operations that meet the definitional requisites, including biological

processes that are part of an integrated process of manufacturing organisms or microorganic ma-

terials through the application of biotechnology. "Production" does not include biological proc-

esses except as otherwise provided by this subsection, wood harvesting operations, the severance

of sand, gravel, oil, gas or other natural resources produced or severed from the soil or water, or

activities such as cooking or preparing drinks, meals, food or food products by a retailer for retail

sale.

36 MRSA §2551, sub-§ 15. Sale price. "Sale price" means the total amount of consideration,

including cash, credit, property and services, for which personal property or services are sold,

leased or rented, valued in money, whether received in money or otherwise, without any deduc-

tion for the cost of materials used, labor or service cost, interest, losses and any other expense of

the seller. "Sale price" does not include:

A. Discounts allowed and taken on sales;

B. Allowances in cash or by credit made upon the return of services pursuant to

warranty;

C. The price of services rejected by customers when the full sale price is re-

funded either in cash or by credit; or

D. The amount of any tax imposed by the United States or the State on or with

respect to the sale of a service, whether imposed upon the seller or the consumer.

36 MRSA § 2552. Tax imposed

1. Rate. A tax at the rate of 5% is imposed on the value of the following services sold in

this State:

A. Extended cable television services;

B. Fabrication services;

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8