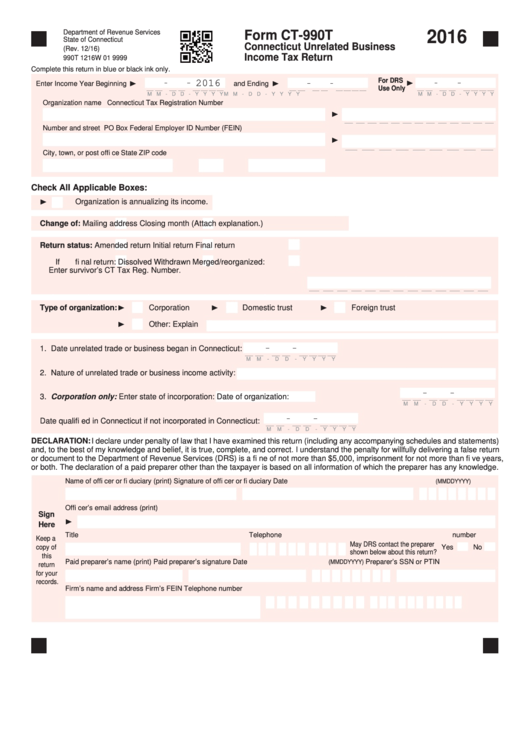

Form Ct-990t - Connecticut Unrelated Business Income Tax Return - 2016

ADVERTISEMENT

Department of Revenue Services

Form CT-990T

2016

State of Connecticut

Connecticut Unrelated Business

(Rev. 12/16)

Income Tax Return

990T 1216W 01 9999

Complete this return in blue or black ink only.

For DRS

2016

Enter Income Year Beginning

and Ending

Use Only

M M - D D - Y Y Y Y

M M - D D - Y Y Y Y

M M - D D - Y Y Y Y

Organization name

Connecticut Tax Registration Number

Number and street

PO Box

Federal Employer ID Number (FEIN)

City, town, or post offi ce

State

ZIP code

Check All Applicable Boxes:

Organization is annualizing its income.

Change of:

Mailing address

Closing month (Attach explanation.)

Return status:

Amended return

Initial return

Final return

If fi nal return:

Dissolved

Withdrawn

Merged/reorganized:

Enter survivor’s CT Tax Reg. Number.

Type of organization:

Corporation

Domestic trust

Foreign trust

Other: Explain

1. Date unrelated trade or business began in Connecticut:

M

M

-

D

D

-

Y

Y

Y

Y

2. Nature of unrelated trade or business income activity:

3. Corporation only: Enter state of incorporation:

Date of organization:

M

M

-

D

D

-

Y

Y

Y

Y

Date qualifi ed in Connecticut if not incorporated in Connecticut:

M

M

-

D

D

-

Y

Y

Y

Y

DECLARATION: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return

or document to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment for not more than fi ve years,

or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Name of offi cer or fi duciary (print)

Signature of offi cer or fi duciary

Date

(MMDDYYYY)

Offi cer’s email address (print)

Sign

Here

Title

Telephone number

Keep a

May DRS contact the preparer

copy of

Yes

No

shown below about this return?

this

Paid preparer’s name (print)

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

(MMDDYYYY)

return

for your

records.

Firm’s name and address

Firm’s FEIN

Telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4