Form Ct-990t - Connecticut Unrelated Business Income Tax Return - 2016 Page 4

ADVERTISEMENT

Form CT-990T (Rev. 12/16)

CT Tax Registration Number

Page 4 of 4

990T 1216W 04 9999

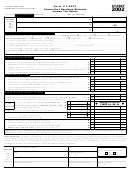

Schedule B –– Connecticut Apportioned Operating Loss Carryover Applied to 2016

.00

1.

2000 Connecticut net operating loss available for use in 2016 ................................................... 1.

2.

2001 Connecticut net operating loss available for use in 2016 ................................................... 2.

.00

.00

3.

2002 Connecticut net operating loss available for use in 2016 ................................................... 3.

.00

4.

2003 Connecticut net operating loss available for use in 2016 ................................................... 4.

.00

5.

2004 Connecticut net operating loss available for use in 2016 ................................................... 5.

.00

6.

2005 Connecticut net operating loss available for use in 2016 ................................................... 6.

7.

2006 Connecticut net operating loss available for use in 2016 ................................................... 7.

.00

.00

8.

2007 Connecticut net operating loss available for use in 2016 ................................................... 8.

9.

2008 Connecticut net operating loss available for use in 2016 ................................................... 9.

.00

.00

10. 2009 Connecticut net operating loss available for use in 2016 ................................................... 10.

.00

11. 2010 Connecticut net operating loss available for use in 2016 ................................................... 11.

.00

12. 2011 Connecticut net operating loss available for use in 2016 ................................................... 12.

.00

13. 2012 Connecticut net operating loss available for use in 2016 ................................................... 13.

14. 2013 Connecticut net operating loss available for use in 2016 ................................................... 14.

.00

.00

15. 2014 Connecticut net operating loss available for use in 2016 ................................................... 15.

16. 2015 Connecticut net operating loss available for use in 2016 ................................................... 16.

.00

17. Total: Add Lines 1 through 16. Enter here and on Computation of Tax, Line 4.

.00

Do not exceed 50% of Computation of Tax, Line 3. .................................................................... 17.

Schedule C –– Computation of Net Operating Loss Carryforward

.00

1.

Enter amount from Computation of Income, Line 6, if less than zero. ......................................... 1.

2.

Add back specifi c deduction from 2016 federal Form 990-T, Part II, Line 33

............................... 2.

.00

.00

3.

Subtotal: Add Line 1 and Line 2. .................................................................................................. 3.

0

4.

Apportionment fraction from Schedule A, Line 5 .......................................................................... 4.

.

5.

2016 Connecticut net operating loss available for carryforward:

.00

Line 3 or Line 3 multiplied by Line 4. ............................................................................................ 5.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4