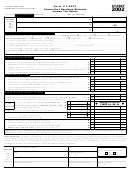

Form Ct-990t - Connecticut Unrelated Business Income Tax Return - 2016 Page 3

ADVERTISEMENT

Form CT-990T (Rev. 12/16)

CT Tax Registration Number

Page 3 of 4

990T 1216W 03 9999

Schedule A –– Unrelated Business Income Apportionment (

See instructions.)

Complete this schedule if the taxpayer’s unrelated trade or business is conducted at a regular place of business outside Connecticut.

Column A

Column B

Column C

Connecticut

Everywhere

Divide Column A by Column B.

Factor

Item

Carry to six places

00

00

1a. Inventories

.

.

00

00

1b. Tangible property

.

.

Property

00

00

1c. Real property

.

.

(Average value)

00

00

1d. Capitalized rent

.

.

00

00

0

1. Total

.

.

.

00

00

2a. Sales of tangibles

.

.

00

00

2b. Services

.

.

00

00

Receipts

2c. Rentals

.

.

00

00

2d. Other

.

.

00

00

0

2. Total

.

.

.

Wages, salaries,

and other

00

00

0

3. Total

.

.

.

compensation

0

4. Total: Add Lines 1, 2, and 3 in Column C.

.

5. Apportionment fraction: Divide Line 4 by number of factors used. Enter here; on

0

Schedule C, Line 4; and on Page 2, Computation of Tax, Line 2.

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4