Distributors Tax Return - Kanzas Department Of Revenue Customer Relations - Form

ADVERTISEMENT

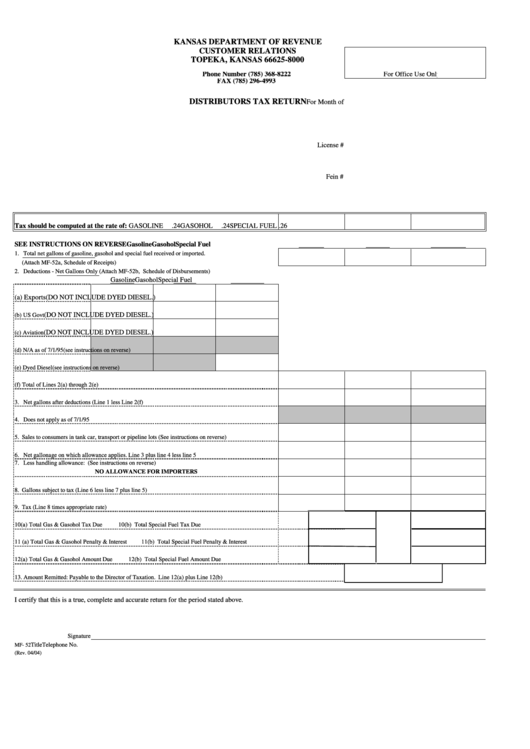

KANSAS DEPARTMENT OF REVENUE

CUSTOMER RELATIONS

TOPEKA, KANSAS 66625-8000

Phone Number (785) 368-8222

For Office Use Only

FAX (785) 296-4993

DISTRIBUTORS TAX RETURN

For Month of

License #

Fein #

Tax should be computed at the rate of:

GASOLINE

.24

GASOHOL

.24

SPECIAL FUEL .26

SEE INSTRUCTIONS ON REVERSE

Gasoline

Gasohol

Special Fuel

1. Total net gallons of gasoline, gasohol and special fuel received or imported.

(Attach MF-52a, Schedule of Receipts)

2. Deductions - Net Gallons Only (Attach MF-52b, Schedule of Disbursements)

Gasoline

Gasohol

Special Fuel

(a) Exports

(DO NOT INCLUDE DYED DIESEL.)

(DO NOT INCLUDE DYED DIESEL.)

(b) US Govt

(DO NOT INCLUDE DYED DIESEL.)

(c) Aviation

(d) N/A as of 7/1/95

(see instructions on reverse)

(e) Dyed Diesel

(see instructions on reverse)

(f) Total of Lines 2(a) through 2(e)

3. Net gallons after deductions (Line 1 less Line 2(f)

4. Does not apply as of 7/1/95

5. Sales to consumers in tank car, transport or pipeline lots (See instructions on reverse)

6. Net gallonage on which allowance applies. Line 3 plus line 4 less line 5

7. Less handling allowance: (See instructions on reverse)

NO ALLOWANCE FOR IMPORTERS

8. Gallons subject to tax (Line 6 less line 7 plus line 5)

9. Tax (Line 8 times appropriate rate)

10(a) Total Gas & Gasohol Tax Due

10(b) Total Special Fuel Tax Due

11 (a) Total Gas & Gasohol Penalty & Interest

11(b) Total Special Fuel Penalty & Interest

12(a) Total Gas & Gasohol Amount Due

12(b) Total Special Fuel Amount Due

13. Amount Remitted: Payable to the Director of Taxation. Line 12(a) plus Line 12(b)

I certify that this is a true, complete and accurate return for the period stated above.

Signature

MF- 52

Title

Telephone No.

(Rev. 04/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2