Form 355x Instructions

ADVERTISEMENT

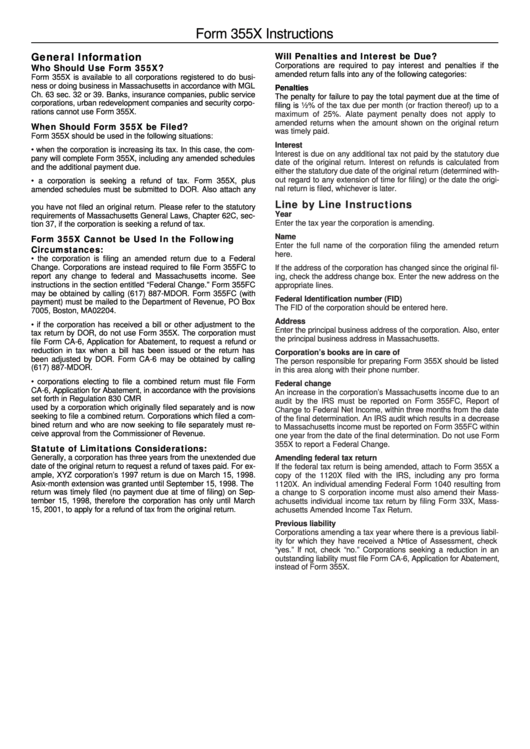

Form 355X Instructions

General Information

Will Penalties and Interest be Due?

Corporations are required to pay interest and penalties if the

Who Should Use Form 355X?

amended return falls into any of the following categories:

Form 355X is available to all corporations registered to do busi-

ness or doing business in Massachusetts in accordance with MGL

Penalties

Ch. 63 sec. 32 or 39. Banks, insurance companies, public service

The penalty for failure to pay the total payment due at the time of

corporations, urban redevelopment companies and security corpo-

¹⁄₂% of the tax due per month (or fraction thereof) up to a

filing is

rations cannot use Form 355X.

maximum of 25%. A late payment penalty does not apply to

amended returns when the amount shown on the original return

When Should Form 355X be Filed?

was timely paid.

Form 355X should be used in the following situations:

Interest

• when the corporation is increasing its tax. In this case, the com-

Interest is due on any additional tax not paid by the statutory due

pany will complete Form 355X, including any amended schedules

date of the original return. Interest on refunds is calculated from

and the additional payment due.

either the statutory due date of the original return (determined with-

out regard to any extension of time for filing) or the date the origi-

• a corporation is seeking a refund of tax. Form 355X, plus

nal return is filed, whichever is later.

amended schedules must be submitted to DOR. Also attach any

U.S. Form 1120X filed with the IRS. You cannot file Form 355X if

Line by Line Instructions

you have not filed an original return. Please refer to the statutory

Year

requirements of Massachusetts General Laws, Chapter 62C, sec-

Enter the tax year the corporation is amending.

tion 37, if the corporation is seeking a refund of tax.

Name

Form 355X Cannot be Used In the Following

Enter the full name of the corporation filing the amended return

Circumstances:

here.

• the corporation is filing an amended return due to a Federal

Change. Corporations are instead required to file Form 355FC to

If the address of the corporation has changed since the original fil-

report any change to federal and Massachusetts income. See

ing, check the address change box. Enter the new address on the

instructions in the section entitled “Federal Change.” Form 355FC

appropriate lines.

may be obtained by calling (617) 887-MDOR. Form 355FC (with

Federal Identification number (FID)

payment) must be mailed to the Department of Revenue, PO Box

The FID of the corporation should be entered here.

7005, Boston, MA 02204.

Address

• if the corporation has received a bill or other adjustment to the

Enter the principal business address of the corporation. Also, enter

tax return by DOR, do not use Form 355X. The corporation must

the principal business address in Massachusetts.

file Form CA-6, Application for Abatement, to request a refund or

reduction in tax when a bill has been issued or the return has

Corporation’s books are in care of

been adjusted by DOR. Form CA-6 may be obtained by calling

The person responsible for preparing Form 355X should be listed

(617) 887-MDOR.

in this area along with their phone number.

• corporations electing to file a combined return must file Form

Federal change

CA-6, Application for Abatement, in accordance with the provisions

An increase in the corporation’s Massachusetts income due to an

set forth in Regulation 830 CMR 63.32.B.1. Form 355X cannot be

audit by the IRS must be reported on Form 355FC, Report of

used by a corporation which originally filed separately and is now

Change to Federal Net Income, within three months from the date

seeking to file a combined return. Corporations which filed a com-

of the final determination. An IRS audit which results in a decrease

bined return and who are now seeking to file separately must re-

to Massachusetts income must be reported on Form 355FC within

ceive approval from the Commissioner of Revenue.

one year from the date of the final determination. Do not use Form

355X to report a Federal Change.

Statute of Limitations Considerations:

Generally, a corporation has three years from the unextended due

Amending federal tax return

date of the original return to request a refund of taxes paid. For ex-

If the federal tax return is being amended, attach to Form 355X a

ample, XYZ corporation’s 1997 return is due on March 15, 1998.

copy of the 1120X filed with the IRS, including any pro forma

A six-month extension was granted until September 15, 1998. The

1120X. An individual amending Federal Form 1040 resulting from

return was timely filed (no payment due at time of filing) on Sep-

a change to S corporation income must also amend their Mass-

tember 15, 1998, therefore the corporation has only until March

achusetts individual income tax return by filing Form 33X, Mass-

15, 2001, to apply for a refund of tax from the original return.

achusetts Amended Income Tax Return.

Previous liability

Corporations amending a tax year where there is a previous liabil-

ity for which they have received a Notice of Assessment, check

“yes.” If not, check “no.” Corporations seeking a reduction in an

outstanding liability must file Form CA-6, Application for Abatement,

instead of Form 355X.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1