Form 1310n Instructions

ADVERTISEMENT

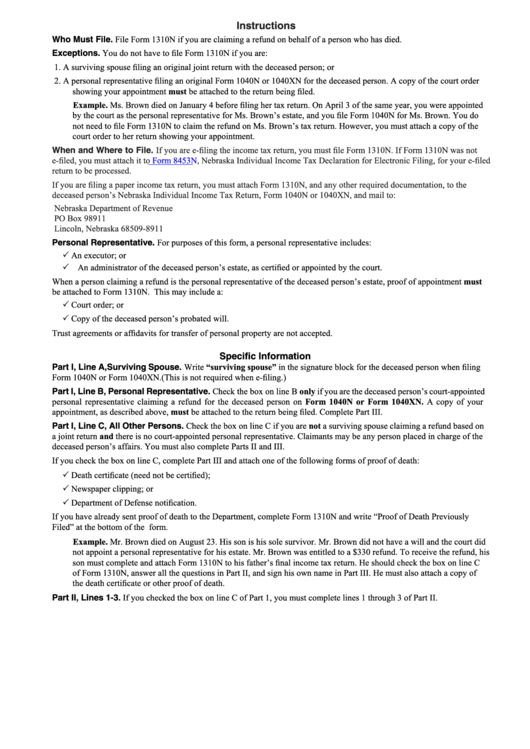

Instructions

Who Must File. File Form 1310N if you are claiming a refund on behalf of a person who has died.

Exceptions. You do not have to file Form 1310N if you are:

1. A surviving spouse filing an original joint return with the deceased person; or

2. A personal representative filing an original Form 1040N or 1040XN for the deceased person. A copy of the court order

showing your appointment must be attached to the return being filed.

Example. Ms. Brown died on January 4 before filing her tax return. On April 3 of the same year, you were appointed

by the court as the personal representative for Ms. Brown’s estate, and you file Form 1040N for Ms. Brown. You do

not need to file Form 1310N to claim the refund on Ms. Brown’s tax return. However, you must attach a copy of the

court order to her return showing your appointment.

When and Where to File. If you are e-filing the income tax return, you must file Form 1310N. If Form 1310N was not

e-filed, you must attach it to

Form

8453N, Nebraska Individual Income Tax Declaration for Electronic Filing, for your e-filed

return to be processed.

If you are filing a paper income tax return, you must attach Form 1310N, and any other required documentation, to the

deceased person’s Nebraska Individual Income Tax Return, Form 1040N or 1040XN, and mail to:

Nebraska Department of Revenue

PO Box 98911

Lincoln, Nebraska 68509-8911

Personal Representative. For purposes of this form, a personal representative includes:

P An executor; or

P An administrator of the deceased person’s estate, as certified or appointed by the court.

When a person claiming a refund is the personal representative of the deceased person’s estate, proof of appointment must

be attached to Form 1310N. This may include a:

P Court order; or

P Copy of the deceased person’s probated will.

Trust agreements or affidavits for transfer of personal property are not accepted.

Specific Information

Part I, Line A, Surviving Spouse. Write “surviving spouse” in the signature block for the deceased person when filing

Form 1040N or Form 1040XN. (This is not required when e-filing.)

Part I, Line B, Personal Representative. Check the box on line B only if you are the deceased person’s court‑appointed

personal representative claiming a refund for the deceased person on Form 1040N or Form 1040XN. A copy of your

appointment, as described above, must be attached to the return being filed. Complete Part III.

Part I, Line C, All Other Persons. Check the box on line C if you are not a surviving spouse claiming a refund based on

a joint return and there is no court‑appointed personal representative. Claimants may be any person placed in charge of the

deceased person’s affairs. You must also complete Parts II and III.

If you check the box on line C, complete Part III and attach one of the following forms of proof of death:

P Death certificate (need not be certified);

P Newspaper clipping; or

P Department of Defense notification.

If you have already sent proof of death to the Department, complete Form 1310N and write “Proof of Death Previously

Filed” at the bottom of the form.

Example. Mr. Brown died on August 23. His son is his sole survivor. Mr. Brown did not have a will and the court did

not appoint a personal representative for his estate. Mr. Brown was entitled to a $330 refund. To receive the refund, his

son must complete and attach Form 1310N to his father’s final income tax return. He should check the box on line C

of Form 1310N, answer all the questions in Part II, and sign his own name in Part III. He must also attach a copy of

the death certificate or other proof of death.

Part II, Lines 1-3. If you checked the box on line C of Part 1, you must complete lines 1 through 3 of Part II.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1