Form 720x - Instructions

ADVERTISEMENT

3

Form 720X (Rev. 3-2013)

Page

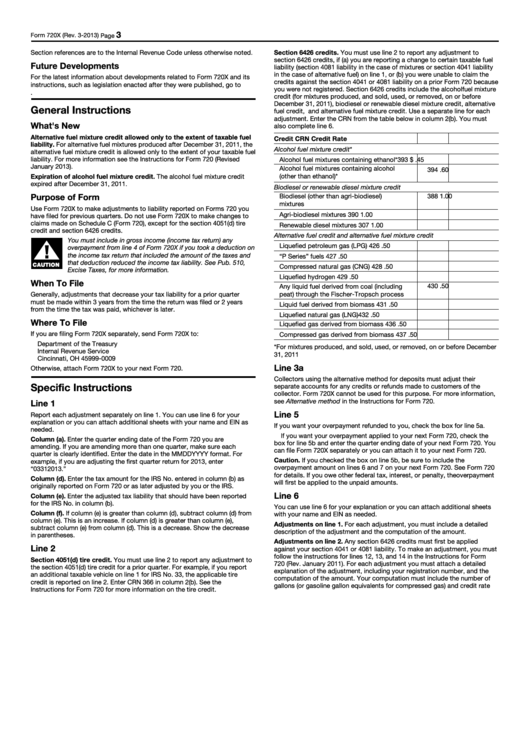

Section 6426 credits. You must use line 2 to report any adjustment to

Section references are to the Internal Revenue Code unless otherwise noted.

section 6426 credits, if (a) you are reporting a change to certain taxable fuel

Future Developments

liability (section 4081 liability in the case of mixtures or section 4041 liability

in the case of alternative fuel) on line 1, or (b) you were unable to claim the

For the latest information about developments related to Form 720X and its

credits against the section 4041 or 4081 liability on a prior Form 720 because

instructions, such as legislation enacted after they were published, go to

you were not registered. Section 6426 credits include the alcohol fuel mixture

credit (for mixtures produced, and sold, used, or removed, on or before

December 31, 2011), biodiesel or renewable diesel mixture credit, alternative

General Instructions

fuel credit, and alternative fuel mixture credit. Use a separate line for each

adjustment. Enter the CRN from the table below in column 2(b). You must

What's New

also complete line 6.

Alternative fuel mixture credit allowed only to the extent of taxable fuel

Credit

CRN

Credit Rate

liability. For alternative fuel mixtures produced after December 31, 2011, the

Alcohol fuel mixture credit*

alternative fuel mixture credit is allowed only to the extent of your taxable fuel

liability. For more information see the Instructions for Form 720 (Revised

Alcohol fuel mixtures containing ethanol*

393

$ .45

January 2013).

Alcohol fuel mixtures containing alcohol

394

.60

Expiration of alcohol fuel mixture credit. The alcohol fuel mixture credit

(other than ethanol)*

expired after December 31, 2011.

Biodiesel or renewable diesel mixture credit

Biodiesel (other than agri-biodiesel)

388

1.00

Purpose of Form

mixtures

Use Form 720X to make adjustments to liability reported on Forms 720 you

Agri-biodiesel mixtures

390

1.00

have filed for previous quarters. Do not use Form 720X to make changes to

claims made on Schedule C (Form 720), except for the section 4051(d) tire

Renewable diesel mixtures

307

1.00

credit and section 6426 credits.

Alternative fuel credit and alternative fuel mixture credit

You must include in gross income (income tax return) any

Liquefied petroleum gas (LPG)

426

.50

!

overpayment from line 4 of Form 720X if you took a deduction on

the income tax return that included the amount of the taxes and

“P Series” fuels

427

.50

that deduction reduced the income tax liability. See Pub. 510,

CAUTION

Compressed natural gas (CNG)

428

.50

Excise Taxes, for more information.

Liquefied hydrogen

429

.50

When To File

430

.50

Any liquid fuel derived from coal (including

Generally, adjustments that decrease your tax liability for a prior quarter

peat) through the Fischer-Tropsch process

must be made within 3 years from the time the return was filed or 2 years

Liquid fuel derived from biomass

431

.50

from the time the tax was paid, whichever is later.

Liquefied natural gas (LNG)

432

.50

Where To File

Liquefied gas derived from biomass

436

.50

If you are filing Form 720X separately, send Form 720X to:

Compressed gas derived from biomass

437

.50

Department of the Treasury

*For mixtures produced, and sold, used, or removed, on or before December

Internal Revenue Service

31, 2011

Cincinnati, OH 45999-0009

Line 3a

Otherwise, attach Form 720X to your next Form 720.

Collectors using the alternative method for deposits must adjust their

Specific Instructions

separate accounts for any credits or refunds made to customers of the

collector. Form 720X cannot be used for this purpose. For more information,

see Alternative method in the Instructions for Form 720.

Line 1

Line 5

Report each adjustment separately on line 1. You can use line 6 for your

explanation or you can attach additional sheets with your name and EIN as

If you want your overpayment refunded to you, check the box for line 5a.

needed.

If you want your overpayment applied to your next Form 720, check the

Column (a). Enter the quarter ending date of the Form 720 you are

box for line 5b and enter the quarter ending date of your next Form 720. You

amending. If you are amending more than one quarter, make sure each

can file Form 720X separately or you can attach it to your next Form 720.

quarter is clearly identified. Enter the date in the MMDDYYYY format. For

Caution. If you checked the box on line 5b, be sure to include the

example, if you are adjusting the first quarter return for 2013, enter

overpayment amount on lines 6 and 7 on your next Form 720. See Form 720

“03312013.”

for details. If you owe other federal tax, interest, or penalty, the overpayment

Column (d). Enter the tax amount for the IRS No. entered in column (b) as

will first be applied to the unpaid amounts.

originally reported on Form 720 or as later adjusted by you or the IRS.

Line 6

Column (e). Enter the adjusted tax liability that should have been reported

for the IRS No. in column (b).

You can use line 6 for your explanation or you can attach additional sheets

Column (f). If column (e) is greater than column (d), subtract column (d) from

with your name and EIN as needed.

column (e). This is an increase. If column (d) is greater than column (e),

Adjustments on line 1. For each adjustment, you must include a detailed

subtract column (e) from column (d). This is a decrease. Show the decrease

description of the adjustment and the computation of the amount.

in parentheses.

Adjustments on line 2. Any section 6426 credits must first be applied

Line 2

against your section 4041 or 4081 liability. To make an adjustment, you must

follow the instructions for lines 12, 13, and 14 in the Instructions for Form

Section 4051(d) tire credit. You must use line 2 to report any adjustment to

720 (Rev. January 2011). For each adjustment you must attach a detailed

the section 4051(d) tire credit for a prior quarter. For example, if you report

explanation of the adjustment, including your registration number, and the

an additional taxable vehicle on line 1 for IRS No. 33, the applicable tire

computation of the amount. Your computation must include the number of

credit is reported on line 2. Enter CRN 366 in column 2(b). See the

gallons (or gasoline gallon equivalents for compressed gas) and credit rate

Instructions for Form 720 for more information on the tire credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2