Form 8879 Instructions

ADVERTISEMENT

2

Form 8879 (2001)

Page

Privacy Act and Paperwork Reduction

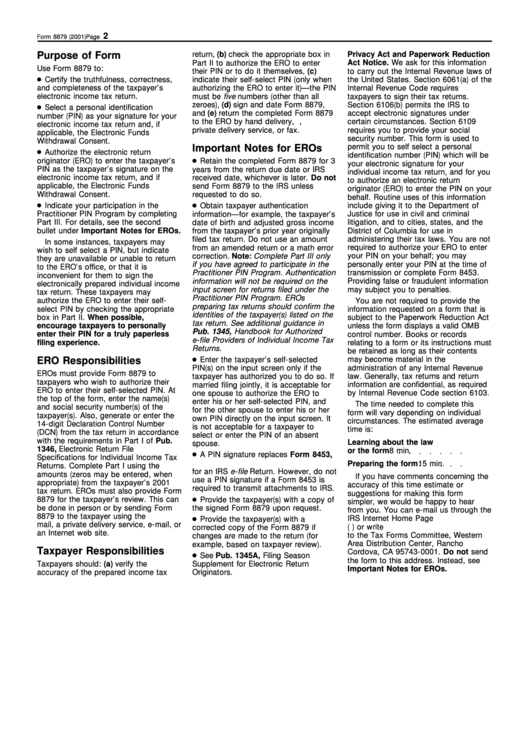

Purpose of Form

return, (b) check the appropriate box in

Part II to authorize the ERO to enter

Act Notice. We ask for this information

Use Form 8879 to:

their PIN or to do it themselves, (c)

to carry out the Internal Revenue laws of

● Certify the truthfulness, correctness,

indicate their self-select PIN (only when

the United States. Section 6061(a) of the

and completeness of the taxpayer’s

authorizing the ERO to enter it)—the PIN

Internal Revenue Code requires

electronic income tax return.

must be five numbers (other than all

taxpayers to sign their tax returns.

zeroes), (d) sign and date Form 8879,

Section 6106(b) permits the IRS to

● Select a personal identification

and (e) return the completed Form 8879

accept electronic signatures under

number (PIN) as your signature for your

to the ERO by hand delivery, U.S. mail,

certain circumstances. Section 6109

electronic income tax return and, if

private delivery service, or fax.

requires you to provide your social

applicable, the Electronic Funds

security number. This form is used to

Withdrawal Consent.

permit you to self select a personal

Important Notes for EROs

● Authorize the electronic return

identification number (PIN) which will be

● Retain the completed Form 8879 for 3

originator (ERO) to enter the taxpayer’s

your electronic signature for your

PIN as the taxpayer’s signature on the

years from the return due date or IRS

individual income tax return, and for you

electronic income tax return, and if

received date, whichever is later. Do not

to authorize an electronic return

applicable, the Electronic Funds

send Form 8879 to the IRS unless

originator (ERO) to enter the PIN on your

Withdrawal Consent.

requested to do so.

behalf. Routine uses of this information

● Indicate your participation in the

● Obtain taxpayer authentication

include giving it to the Department of

Practitioner PIN Program by completing

information—for example, the taxpayer’s

Justice for use in civil and criminal

Part III. For details, see the second

litigation, and to cities, states, and the

date of birth and adjusted gross income

bullet under Important Notes for EROs.

District of Columbia for use in

from the taxpayer’s prior year originally

administering their tax laws. You are not

filed tax return. Do not use an amount

In some instances, taxpayers may

required to authorize your ERO to enter

from an amended return or a math error

wish to self select a PIN, but indicate

correction. Note: Complete Part III only

your PIN on your behalf; you may

they are unavailable or unable to return

if you have agreed to participate in the

personally enter your PIN at the time of

to the ERO’s office, or that it is

Practitioner PIN Program. Authentication

transmission or complete Form 8453.

inconvenient for them to sign the

information will not be required on the

Providing false or fraudulent information

electronically prepared individual income

may subject you to penalties.

input screen for returns filed under the

tax return. These taxpayers may

Practitioner PIN Program. EROs

authorize the ERO to enter their self-

You are not required to provide the

preparing tax returns should confirm the

select PIN by checking the appropriate

information requested on a form that is

identities of the taxpayer(s) listed on the

box in Part II. When possible,

subject to the Paperwork Reduction Act

tax return. See additional guidance in

encourage taxpayers to personally

unless the form displays a valid OMB

Pub. 1345, Handbook for Authorized

enter their PIN for a truly paperless

control number. Books or records

e-file Providers of Individual Income Tax

filing experience.

relating to a form or its instructions must

Returns.

be retained as long as their contents

● Enter the taxpayer’s self-selected

ERO Responsibilities

may become material in the

PIN(s) on the input screen only if the

administration of any Internal Revenue

EROs must provide Form 8879 to

taxpayer has authorized you to do so. If

law. Generally, tax returns and return

taxpayers who wish to authorize their

information are confidential, as required

married filing jointly, it is acceptable for

ERO to enter their self-selected PIN. At

by Internal Revenue Code section 6103.

one spouse to authorize the ERO to

the top of the form, enter the name(s)

enter his or her self-selected PIN, and

The time needed to complete this

and social security number(s) of the

for the other spouse to enter his or her

form will vary depending on individual

taxpayer(s). Also, generate or enter the

own PIN directly on the input screen. It

circumstances. The estimated average

14-digit Declaration Control Number

is not acceptable for a taxpayer to

time is:

(DCN) from the tax return in accordance

select or enter the PIN of an absent

with the requirements in Part I of Pub.

Learning about the law

spouse.

1346, Electronic Return File

or the form

8 min.

● A PIN signature replaces Form 8453,

Specifications for Individual Income Tax

U.S. Individual Income Tax Declaration

Preparing the form

15 min.

Returns. Complete Part I using the

for an IRS e-file Return. However, do not

amounts (zeros may be entered, when

If you have comments concerning the

use a PIN signature if a Form 8453 is

appropriate) from the taxpayer’s 2001

accuracy of this time estimate or

required to transmit attachments to IRS.

tax return. EROs must also provide Form

suggestions for making this form

● Provide the taxpayer(s) with a copy of

8879 for the taxpayer’s review. This can

simpler, we would be happy to hear

be done in person or by sending Form

the signed Form 8879 upon request.

from you. You can e-mail us through the

8879 to the taxpayer using the U.S.

● Provide the taxpayer(s) with a

IRS Internet Home Page

mail, a private delivery service, e-mail, or

( ) or write

corrected copy of the Form 8879 if

an Internet web site.

to the Tax Forms Committee, Western

changes are made to the return (for

Area Distribution Center, Rancho

example, based on taxpayer review).

Taxpayer Responsibilities

Cordova, CA 95743-0001. Do not send

● See Pub. 1345A, Filing Season

the form to this address. Instead, see

Taxpayers should: (a) verify the

Supplement for Electronic Return

Important Notes for EROs.

accuracy of the prepared income tax

Originators.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1