Tax Rates Chart, Transaction Privilege (Sales) Tax Return Form Instructions Etc. Page 2

ADVERTISEMENT

City of Flagstaff

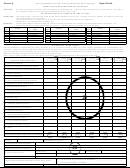

Transaction Privilege (Sales Tax) Return Instructions

The following numbered instructions correspond to the numbered sections of the sample return.

INSTRUCTIONS FOR FRONT OF RETURN

1. Enter pertinent account information in the box in the top right of the page.

If the return is sent from the City, this information will be preprinted.

a. Account Name: Business (Legal) Name

b. Account #: City assigned account #

c. Report Period: Period for which taxes are being paid (I.E- September 2012)

d. Delinquency Date: Last business day of the month after the report period (I.E-

Report Period of September 2012 has a Delinquency Date of 10/31/2012.)

2. Enter account mailing address information as follows:

If the return is sent from the City, this information will be preprinted.

a. Business (Legal) Name

b. Attn:

c. Mailing Address

d. City/State/Zip

3. Check this box if filing a zero return.

a. **Please Note**- A return must be filed each report period (monthly, quarterly,

annual), whether or not there are taxes to report.

4. Select the Tax Description(s) from the table on the back of the return that identifies the

type of tax that will be paid. The descriptions correlate to the tax types found in the

City’s tax code.

If the return is sent from the City, this information will be preprinted.

5. Tax Type: Match the Tax Description as noted in the table on the back of the return.

If the return is sent from the City, this information will be preprinted.

6. Gross Income (Column 1): Enter the gross income, including tax collected, for each

applicable Tax Description. Do not round, use exact dollars and sense.

a. If you report on a cash basis, enter the total amount received, including draws for

construction contracting, in the reporting period.

b. If you report on an accrual basis, enter the total amount per customer invoices,

including progressive billings for construction contracting, in the reporting period.

c. If you file a quarterly or annual return, combine the gross income for the required

months and enter the sum for each Tax Description. Do not list the income for

each month of the filing period.

7. Deductions (Column 2): Enter the total deductions from the bottom row of the back of

the return for each applicable Tax Description. For information on entering deductions,

please see steps 21 and 22. Deductions in column 2 that are not itemized on the back of

the return will be DISALLOWED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5