Tax Rates Chart, Transaction Privilege (Sales) Tax Return Form Instructions Etc. Page 3

ADVERTISEMENT

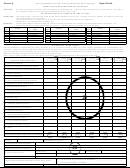

8. Taxable Income (Colum 3): Subtract the total deductions in column 2 from gross income

in column 1.

9. Tax Rate (Column 4): Enter the tax rate applicable to each Tax Type.

If the return is sent from the City, this information will be preprinted.

10. Tax Due (Column 5): Multiply column 3 by column 4 to calculate the total tax due for

each Tax Description.

11. Subtotal (Line 7): Enter the subtotal of lines 1-6.

12. Enter Total Excess City Tax Collected (Line 8): If more tax was collected than is due,

enter the City portion of the Excess City Tax Collected.

13. Total Tax Due (Line 9): Add the total of lines 7 and 8 and enter on line 9.

14. Penalty and Interest (Line 10): If the return is filed after the last business day of the

month, a 10% late payment penalty and a 5% late filing penalty (per month) will be

assessed. The maximum total of these penalties is 25% of the tax due. If this line is

inputted incorrectly or left blank, the City will calculate the correct penalty and interest.

15. Enter Net Amount Due (Line 11): Add the total of lines 9 and 10 on enter on line 11.

16. Enter Total Credit Balance to be Applied (Line 12): If there is a credit balance on your

account, enter the amount of the credit that should be applied to the account. The credit

cannot exceed the total balance due.

17. Enter Total Amount Paid (Line 13): Subtract line 12 from line 11 and enter the number

on line 13.

18. Sign and date the return as required.

19. If this account requires any modifications (ownership, address, etc., check the box and

enter the correct information in the area noted in step 23.

INSTRUCTIONS FOR BACK OF RETURN

20. Enter the Tax Type in the correct column as noted on the front page.

If the return is sent from the City, this information will be preprinted.

21. Enter the itemized deductions in the correct column grouping for each tax type.

Deductions must be itemized. Any deduction not itemized will be DISALLOWED.

22. Enter the total of the deductions for each Tax Type in the last line of the deduction table

and move this number to the correct Tax Type in column 2 on the front page.

23. If there is any change in status on the account, check the box on the front of the return as

noted in Step 19 and fill in the applicable area of the change in status box.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5