Tax Rates Chart, Transaction Privilege (Sales) Tax Return Form Instructions Etc. Page 5

ADVERTISEMENT

Account #:

Report Period:

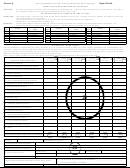

City of Flagstaff Transaction Privilege (Sales) Tax Return (Page 2)

INSTRUCTION AND DEDUCTION EXPLANATIONS

DUE DATE:

Tax returns are due on the 20th of the month following the reporting period. A return must be submitted even if no taxes are due. Tax returns

are considered delinquent if not received by the last business day of the month.

POSTMARKS ARE NOT EVIDENCE OF TIMELY FILING

Late Filing Penalty - A penalty of 5% of the tax due will be assessed for each month, or fraction of a month, between the deliquency date of the

PENALTIES:

return and the date on which it is filed.

Late Payment Penalty - A penalty of 10% of the unpaid tax will be assessed if the tax is not paid timely.

Total Penalty - Total penalties will not exceed 25%

INTEREST:

Taxes unpaid after the delinquency date are assessed interest at the same rate in effect for the Arizona Department of Revenue. Any

outstanding interest is compounded annually on January 1. Interest CAN NOT be abated by the Tax Collector.

Tax

Allowable Deduction

Tax

Allowable Deduction

Tax

Allowable Deduction

Activity

Activity

Activity

Type

Codes

Type

Codes

Type

Codes

1

Transportation

52,53,57,64,75

11

Restaurants/Bars

52,53,57,62,64,65,74,75

18

Advertising

52,53-55,57,62,64,69,75

2

Mining

52,53,57,64,74,75

12

Amusements

52,53,57,64,75

25

Hotel/Motel

52,53,57,64,75

4

Utilities

52-54,57,64,65,75

13

Commercial Property Rental

52-54.57.64.75

31

Cable Franchise

52-54,57,64,75

5

Telecommunications

52-54-57,64,66,75

14

Personal Property Rental

52-55,57,58,62-65,73-75

32

Natural Gas Franchise

52-54,57,64,65,75

9

Publishing

52-54,55,57,64,65,69,75

15

Contracting

52-53,55,57,62,64,70-71,75

33

Telecom Franchise

52-54,57,64,66,75

10

Job Printing

52-55,57,64,65,74,75

17

Retail Sales

51-59,63-65,73-75

34

Electric Franchise

52-54,57,64,65,75

35

Bed, Board, and Booze

52,53,57,64,75

SCHEDULE A - DEDUCTIONS

Enter the deductions and exclusions you used in computing your City Transaction Privilege (Sales) Tax. You must keep a detailed record of all deductions and

exclusions. Failure to maintain proper documentation and records required by City ordinance may result in their disallowance. A separate detail of city records

and documentation must be maintained only when the income, deductions or exemptions are different than the state’s. The table above is a guide for allowable

deductions and should not be construed to be complete or all encompassing.

Note: The line numbers listed at the top of the columns listed below correspond with the line number for tax type on the front.

Line 1

Line 2

Line 3

Line 4

Line 5

Line 6

20

20

20

20

20

20

Deduction Code & Description

Tax Type:

Tax Type:

Tax Type:

Tax Type:

Tax Type:

Tax Type:

51 - Exempt Food Sales

52 - Discounts Allowed (If Included in Gross)

53 - Refund and Returns (If Included in Gross)

54 - Sales for Resale

55 - Out-of-State Sales

56 - 50% of Retail Sales to US Government

57 - Bad Debt on Which Tax Was Paid

58 - Prescriptions/Prosthetics

59 - Gasoline and Use Fuel Sales

62 - Out-of-City Sales

21

63 - Service Labor

64 - Privilege (Sales) Tax Factored or Collected

65 - Qualifying Healthcare Sales

66 - Interstate Telecommunications

69 - National Advertising

70 - 35% Construction Contracting

71 - Subcontracting Income

73 - Exempt Capital Equipment

74 - Freight Out/Delivery Charges

75 - Other:

75 - Other:

22

22

Total Deductions (Move to Column 2 on Front Page)

22

22

22

22

Change in Status

Account

Effective Date of Change:

My business name has changed to:

My business has moved to:

23

My mailing address has changed to:

Landlord name:

Landlord number:

My new location is rented.

Landlord mailing address:

My phone number changed.

New business phone number:

New mailing phone number:

®

The ownership of my business has changed to: _____________________________

Please send a new license application for the following reason:

®

I have another location in Flagstaff: _______________________________________

Please cancel my license for the reason noted:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5