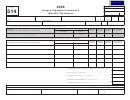

WORKSHEET OF MOTOR FUEL GALLONS

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

From

Clear

Form 2994

100%

Dyed

EXPORT SALES

Aviation

Blending

Diesel &

Schedule

Gasoline

Ethyl

Gasohol

Diesel &

Jet Fuel

Gasoline

Components

Clear

Alcohol

Kerosene

Kerosene

7

1W. Gallons exported by suppliers . . . . . . . . . . . . .

2W. Gallons removed by licensed distributors

5H

for export (Destination state tax paid) . . . . . . .

3W. Total export sales (Lines 1W and 2W) . . . . . . . . . . . . . . . .

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

From

Clear

Form 573

100%

Dyed

ADJUSTMENTS

Aviation

Blending

Diesel &

Schedule

Gasoline

Ethyl

Gasohol

Diesel &

Jet Fuel

Gasoline

Components

Clear

Alcohol

Kerosene

Kerosene

1

4A. Gallons received tax and/or fees paid . . . . . . . .

4B. Sales to U.S. government (credit card and

Form 2994

Form 4776, Ultimate Vendor Certificate) . . . . .

10D

4W. Total adjustments (Lines 4A and 4B; enter on

Line 2, front of report) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

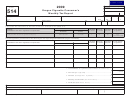

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

From

TAX EXEMPT SALES

Clear

100%

Dyed

Form 2994

Aviation

Blending

(FEES APPLY)

Diesel &

Gasoline

Ethyl

Gasohol

Diesel &

Jet Fuel

Schedule

Gasoline

Components

Clear

Alcohol

Kerosene

Kerosene

5W. Gallons delivered to U.S. government

8

tax exempt . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6W. Clear kerosene sold for non-highway

6

use and jet fuel . . . . . . . . . . . . . . . . . . . . . . . .

7W. Gallons of dyed diesel and dyed kerosene

5A + 5B

removed for nonhighway use . . . . . . . . . . . . .

8W. Total tax exempt gallons (Lines 5W through 7W) . . . . . .

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

From

Clear

100%

Dyed

TAX AND FEE EXEMPT SALES

Form 2994

Aviation

Blending

Diesel &

Gasoline

Ethyl

Gasohol

Diesel &

Jet Fuel

Schedule

Gasoline

Components

Clear

Alcohol

Kerosene

Kerosene

6

9W. Gallons of other tax-exempt fuel . . . . . . . . .

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

From

Clear

100%

Dyed

TAXABLE SALES

Form 2994

Aviation

Blending

Diesel &

Gasoline

Ethyl

Gasohol

Diesel &

Jet Fuel

Schedule

Gasoline

Clear

Components

Alcohol

Kerosene

Kerosene

5A + 5B

10W. Taxable sales . . . . . . . . . . . . . . . . . . . . . . . . . .

11W. Enter gallons of the blending components

5A + 5B

under the fuel type which it was added . . . . . .

12W. Dyed diesel sold for taxable purposes from

5F

in-state terminals (Missouri tax collected) . . . .

13W. Dyed diesel sold for taxable purposes

5G

for import . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14W. State diversion corrections (Plus

Form 4758

or minus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Sched. 11

15W. Total taxable gallons (Lines 10W through 14W)

(Enter on Line 1, front of report) . . . . . . . . . . . . . . . . . . . . .

This publication is available upon request in alternative accessible format(s).

MO 860-1416 (11-2006)

1

1 2

2 3

3 4

4