INSTRUCTIONS

9. If you have a motor fuel tax credit or debit from a previous

report, you will receive a letter. Add (+) or subtract ( – ) the

amount of your motor fuel tax credit or debit and attach a copy

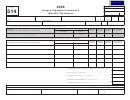

FOR SUPPLIER/PERMISSIVE SUPPLIER’S

of the authorization. If you are remitting delinquent tax received

TAX REPORT

from an eligible purchaser, complete Form 591 and include

This report and its supporting schedules must be fully completed

figure on Line 9.

and mailed to the Missouri Department of Revenue in accordance

10. Total motor fuel tax due. (Total of Lines 8 and 9.)

with the dates listed below. The tax is due and payable on or before

the second day of the second succeeding month unless such day

INSPECTION FEE

falls upon a weekend or state holiday in which case the liability

11. Total gallons subject to inspection fee. (Line 8W plus (+) Line

would be due the next succeeding business day.

15W minus ( – ) Line 4A from worksheet.

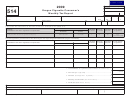

Gallons Removed

Date Tax is Due

12. Inspection fee rate $0.025 per 50 gallons. The rate per gallon is

January

March 2, 2007

0.0005 (Line 11 times (X) .0005).

February

April 2, 2007

13. If you have an inspection fee credit or debit from a previous

March

May 2, 2007

report, you will receive a letter. Add (+) or subtract ( – ) the

April

June 4, 2007

amount of your inspection fee credit or debit and attach a copy

May

July 2, 2007

of the authorization. If you are remitting a delinquent inspection

June

August 2, 2007

fee from an eligible purchaser, complete Form 591 and include

July

September 4, 2007

figure on Line 13.

August

October 2, 2007

14. Total inspection fee due (Total of Lines 12 and 13).

September

November 2, 2007

October

December 3, 2007

November

January 2, 2008

TRANSPORT LOAD FEE

December

February 4, 2008

15. Total gallons of fuel subject to transport load fee (From Line

11).

Computer generated reports and schedules must contain all the

16. Motor fuel gallons sold to railroad corporations and airline

information required on the original reports and schedules. (Reports

companies are not subject to transport load fee. (Total from

must be postmarked by the due date.) A report is due whether or

attached Form 10).

not there was any activity during the month.

17. Total gallons subject to transport load fee (Line 15 minus

ROUND TO WHOLE GALLONS AND WHOLE DOLLARS.

( – ) Line 16).

18. Transport load fee (Line 17 times (X) 0.005).

BEFORE COMPLETING FRONT PAGE OF REPORT, COMPLETE

19. If you have a transport load fee credit or debit from a previous

ALL CORRESPONDING SCHEDULES AND ATTACHED WORK-

report, you will receive a letter. Add (+) or subtract ( – ) the

SHEET

amount of your transport load fee credit or debit and attach a

1. Gross taxable gallons. Enter the figure from Line 15W on the

copy of the authorization. If you are remitting a delinquent

worksheet. Attach completed schedules 5A, 5B, 5F, 5G, and 11.

transport load fee from an eligible purchaser, complete Form

2. Total adjustments. Enter the figure from Line 4W on worksheet

591 and include figure on Line 19.

and attach completed Form 573, Schedule 1 and/or Form 2994,

20. Total transport load fee due (Total of Lines 18 and 19).

Schedule 10D.

3. Taxable gallons. The difference between Line 1 minus (–) Line 2.

TAXES AND FEES DUE

4. The motor fuel tax law allows a 3 percent deduction on the

21. Total motor fuel tax due (Total from Line 10, Columns A, B, C,

number of gallons of gasoline, alcohol, gasohol, and aviation

E, and F).

fuel. There is a 2 percent deduction on the number of gallons of

22. Total aviation gasoline tax due (Total from Line 10, Column D).

clear diesel and clear kerosene. Compute Line 3 times (X) the

corresponding percentage. If a monthly report is not filed on time

23. Total inspection fee due (Total from Line 14).

or the tax or is not paid by the due date, enter zero on Line 4.

24. Total transport load fee due (Total from Line 20).

5. Net taxable gallons (Line 3 minus ( – ) Line 4).

25. Total tax and fees due (Total from Lines 21, 22, 23, and 24).

TAX CALCULATION

PENALTY

26. If your report is not filed on a timely basis or taxes and fees are

TAX RATES

not paid timely, (as shown by the United States Postal Service

Tax rate for gasoline, alcohol blended with gasoline, gasohol and

postmark stamped on the envelope), you are subject to a penalty

other products blended with gasoline, clear diesel, clear kerosene

of 5 percent per month up to a maximum of 25 percent of the

and other products blended with clear diesel or clear kerosene is

total tax and fees due (Line 26 times (X) penalty amount, 5

$0.17 per gallon. Aviation gasoline tax rate is $0.09 per gallon.

percent up to 25 percent).

6. Tax due is based on the taxable gallons times (X) the corre-

sponding tax rates. (Line 5 times (X) $0.17 or $0.09 for aviation

gasoline fuel tax.)

INTEREST

7. Every supplier and permissive supplier who properly remits tax in

27. Interest is due on any late payments of tax or fees (Line 25 times

accordance with Chapter 142 shall be allowed to retain one-tenth

(X) the annual percentage rate of 8 percent multiplied by the

of one percent of the tax imposed (Line 6 times (X) 0.001).

number of days late divided by 365—366 for leap years). The

8. Tax due by supplier (Line 6 minus ( – ) Line 7).

daily rate is .0002192.

MO 860-1416 (11-2006)

1

1 2

2 3

3 4

4