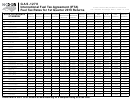

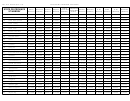

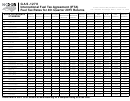

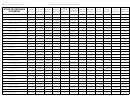

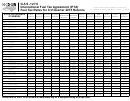

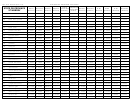

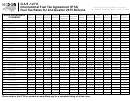

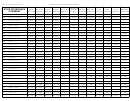

Form Gas-1276 - International Fuel Tax Agreement (Ifta) Return Page 2

ADVERTISEMENT

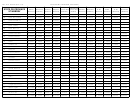

Form Gas 1276 IFTA-I (Reverse)

Column (7) Net Taxable or (Credit) Gallons - This figure is the difference between taxable gallons and tax-paid gallons.

To calculate this difference, subtract Column 6 from Column 5. If Column 5 is greater than Column 6, you will owe additional

tax. If Column 5 is less than Column 6, this figure should include parenthesis ( ) to indicate a credit is due.

Column (8) Tax Rate - Use the tax rate sheet (Form Gas-1278) to enter the tax rate by jurisdiction by product type.

Column (9) Tax or (Credit) - Multiply Column 7 by Column 8.

Column (10) Interest - If your return is late, you will be subject to interest for each jurisdiction on which tax is due (Column

9). For jurisdictions with surcharges, add the tax to or subtract the credit from the surcharge amount. If the result is a tax

due, interest is calculated on this amount. To calculate the interest payment, multiply the TAX DUE (Column 9) by the interest

rate by the number of months late. A partial month is considered a full month when determining the number of months late.

The current interest rate can be obtained from the Department’s website at

DO NOT CALCULATE INTEREST FOR CREDITS.

Column (11) Total Tax or (Credit) Due - Add the totals of Column 9 and Column 10 for each jurisdiction listed.

SUBTOTALS - Add the subtotals for each page and enter the total tax and total interest on Page 1, Lines 1 and 3.

PAGE 1 - Computation of Tax or (Credit)

Line 1

Tax or (Credit) Due - Enter the total tax or (credit) due from Schedule B, Column 9, all pages. If the amount

on Line 1 is a (credit), fill in the circle to the left of the boxes to denote a credit amount. Do not use parentheses

or dashes.

Line 2

Penalty - Returns are due on the last day of the month following the close of each quarter.

a.

If the return is late and no tax is due, a penalty of $50 is due.

b.

If the return is late and tax is due, a penalty of $50 PLUS 10% of the tax due or $50, whichever is greater,

is due.

c.

If the return is on time but underpaid, a penalty of 10% of the tax due or $50, whichever is greater, is due.

Line 3

Interest Due - Enter the total interest due from Schedule B, Column 10, all pages.

Line 4

Total Balance or (Credit) Due - Add Lines 1 through 3.

1.

If Balance Due - Mail the return and a check for the balance due to the North Carolina Department of

Revenue, Excise Tax Division, P. O. Box 25000, Raleigh, NC 27640-0950.

Any payment must be drawn on a U.S. (domestic) bank and payable in U.S. dollars.

2.

If (Credit) Due - Fill in the circle to the left of the boxes to denote a credit amount. Do not use parentheses

or dashes. Mail the return to the North Carolina Department of Revenue, Excise Tax Division, P. O. Box

25000, Raleigh, NC 27640-0950. Refunds less than $1.00 must be requested in writing.

Please include your signature, title, date, and telephone number.

Anyone who fails to file a return on time will be subject to a penalty of $50.00 for each offense. This penalty is in

addition to the penalty for failure to pay tax when due. In addition, your license plate(s) will be subject to revocation

if returns and/or payments are not submitted to the Department.

MAIL TO:

QUESTIONS:

North Carolina Department of Revenue

Contact the Excise Tax Division at:

Excise Tax Division

Telephone Number

(919) 707-7500

Post Office Box 25000

Toll Free Number

(877) 308-9092

Raleigh, North Carolina 27640-0950

Fax Number

(919) 733-8654

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13